The enthusiasm over the stock market last week was dampened for most of the week by worries over the potential impact of Hurricane Florence. Though the storm fortunately weakened by Friday there is likely to be a very negative long-term impact on the region as massive flooding is expected.

Stocks held early gains even as shares of Apple and Asia-based suppliers slumped after President Donald Trump insisted his trade war with China will spur more manufacturing jobs in the U.S. Photographer: Michael Nagle/Bloomberg

On Friday the stock market had to also deal with the new developments regarding former campaign chair Paul Manafort and the mid-afternoon announcement that President Trump was moving forward on plans for another $200 billion in tariffs. This reversed the positive market impact from Thursday that the Chinese were invited to new trade talks by Treasury Secretary Mnuchin.

TOMASPRAY-VIPERREPORT.COM

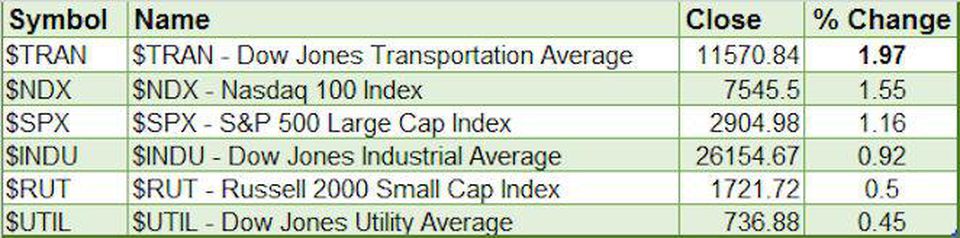

For the week the Dow Jones Transports led the way gaining 1.97%. It has been strong all month and the positive performance for all of the major averages keeps the bullish momentum intact. This was a bullish development for the Nasdaq 100 (NDX) as it had dropped 2.9% the previous week. Over the past few weeks the small-cap Russell 2000 has lagged the S&P 500 and that trend continued last week.

TOMASPRAY-VIPERREPORT.COM

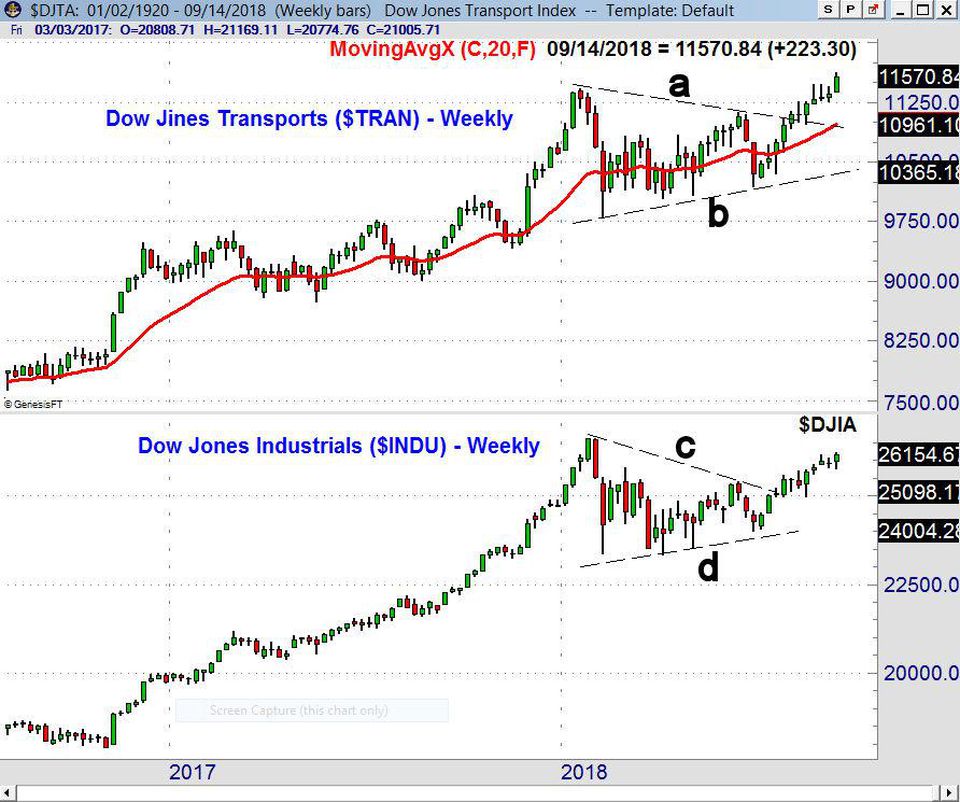

The weekly chart of the Dow Jones Transports shows that it completed the flag formation, lines a and b, at the start of August. The price target from the formation is in the 12,700-800 area which is 10% above Friday’s close. The weekly chart of the Dow Jones Industrials show that it has not yet surpassed the January high at 26.616. The completion of the chart formation (lines c and d) on the Dow Industrials has upside targets in the 29,800-30,200 area.

TOMASPRAY-VIPERREPORT.COM

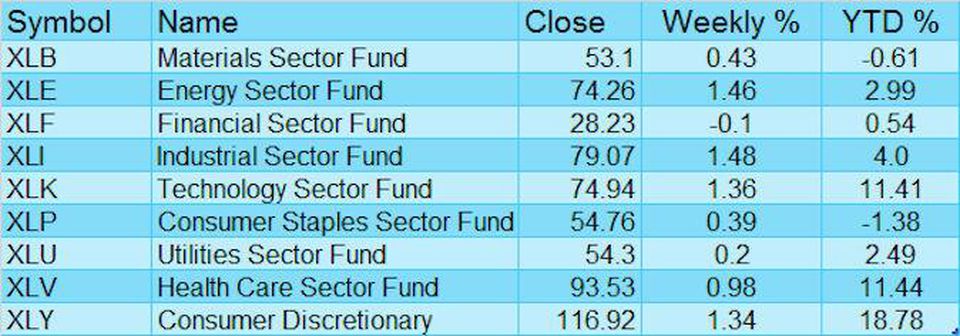

Given the performance of the Dow Transports it is not surprising that the Industrials Sector Fund (XLI) was one of the week’s best performers up 1.48%. This ETF is only up 4% YTD while one of the week’s other best performers, the Technology Sector Fund (XLK) is up 11.41% YTD. The Energy Sector (XLE) was up 1.46% last week while the Consumer Discretionary (XLY) gained 1.34%. The positive relative performance analysis on XLY has been discussed since early in the year.

Leave A Comment