The Dow dropped 1300 points in a couple of days and the CNBC fear machine cranked into high gear. Even Fox Business News got into the action with the headline grabber “Biggest market crash in our lifetime coming – economist Harry Dent”. Of course, if you google “Harry Dent crash”, he makes the same call every year so it is meaningless. The real question is: should you buy or sell the fear? The answer: it depends.

Buy the fear

Warren Buffett’s famous quote is “Be fearful when others are greedy and be greedy when others are fearful”.

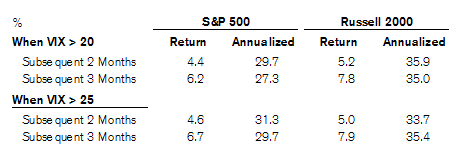

Buying spikes in the fear index, aka the VIX, has lead to above average returns in subsequent months. CSFB’s Jonathan Golub ran the numbers from 2010 to today and it shows the great performance if you buy VIX above 20 or 25. Note that yesterday, the VIX hit 26.88 and today is still above 22.

Sell the fear

Of course, this works well in a bull market like Golub shows. However, you don’t always want to buy fear especially if you are entering a new bear market. For example, if you bought the VIX above 20 in 2008, you would have been in for a world of pain. The VIX went above 30 several times and then to 80 in the fall.

Buy or sell today?

We lean toward the side of buying this dip because the economy is still strong and corporate earnings are growing above 20%. Keep in mind that the market is unlikely to recover in a straight line up so you can be patient in buying the dips over the next few weeks.

Leave A Comment