Wyndham Worldwide Corporation (NYSE: WYN) trades at a P/E multiple of 13.1x, which is lower than the Consumer Discretionary sector median of 18.7x. While this makes WYN appear like a stock to add to your portfolio, you might change your mind after gaining a better understanding of the assumptions behind the P/E ratio. In this article, I will break down what the P/E ratio is, how to interpret it and what to watch out for.

Understanding Valuation Multiples and the P/E Ratio

A Multiples Valuation, also known as a Comparable Companies Analysis, determines the value of a subject company by benchmarking the subject’s financial performance against similar public companies (Peer Group). We can infer if a company is undervalued or overvalued relative to its peers by comparing metrics like growth, profit margin, and valuation multiples.

A P/E Multiple is a valuation ratio that indicates the multiple of earnings investors are willing to pay for one share of a company:

P/E Multiple = Stock Price ÷ Earnings Per Share

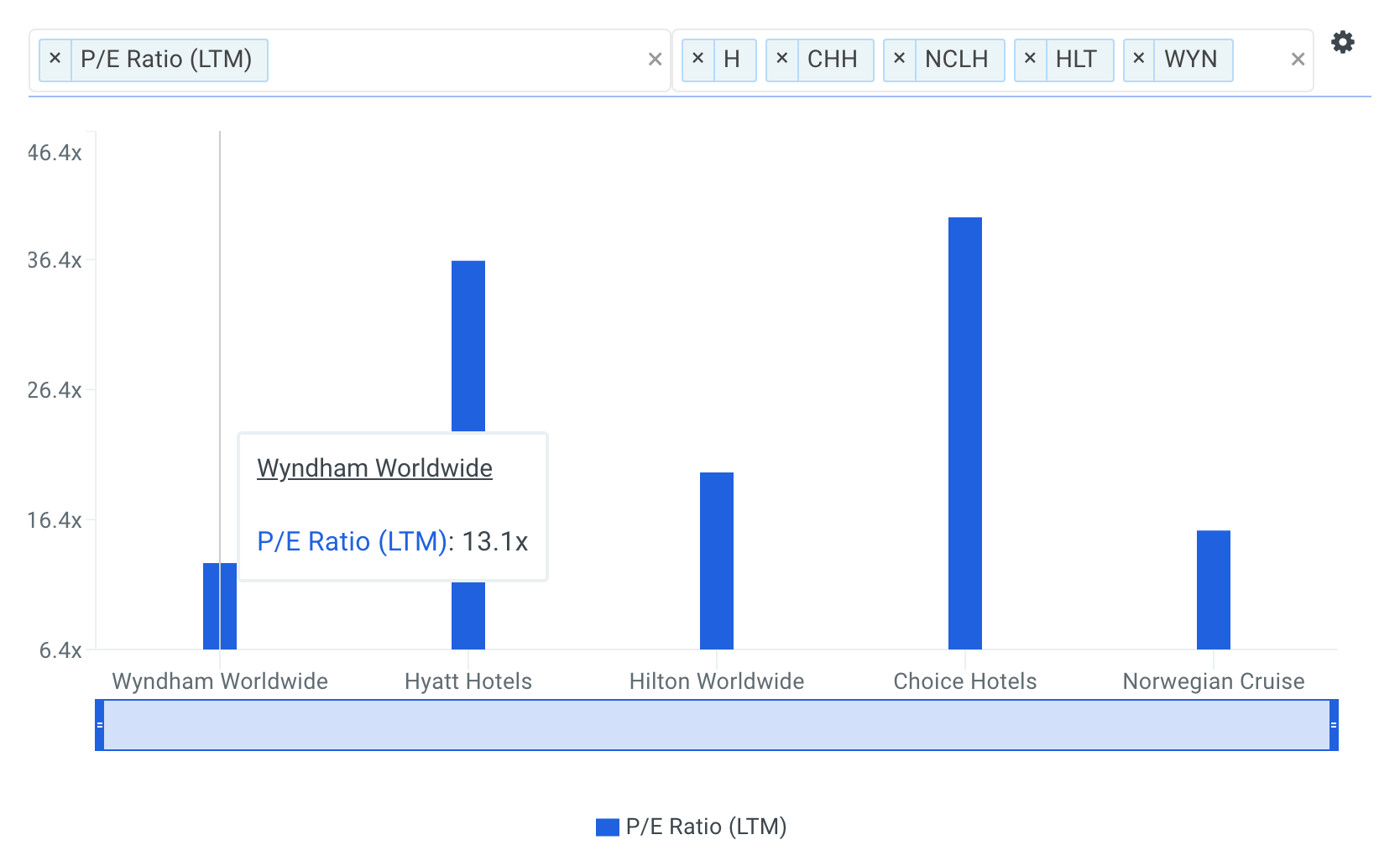

The P/E ratio is not meant to be viewed in isolation and is only useful when comparing it to other similar companies. Since it is expected that similar companies have similar P/E ratios, we can come to some conclusions about the stock if the ratios are different. I compare Wyndham Worldwide’s P/E multiple to those of Hyatt Hotels Corporation (NYSE: H), Hilton Worldwide Holdings Inc. (NYSE: HLT), Choice Hotels International, Inc. (NYSE: CHH) and Norwegian Cruise Line Holdings Ltd. (NCLH) in the chart below.

source: finbox.io Benchmarks: P/E Multiples

Since Wyndham Worldwide’s P/E of 13.1x is lower than the median of its peers (28.2x), it means that investors are paying less than they should for each dollar of WYN’s earnings. As such, our analysis shows that WYN represents an undervalued stock. In fact, finbox.io’s P/E Multiple Model calculates a fair value of $169.58 per share which implies 52.7% upside.

Leave A Comment