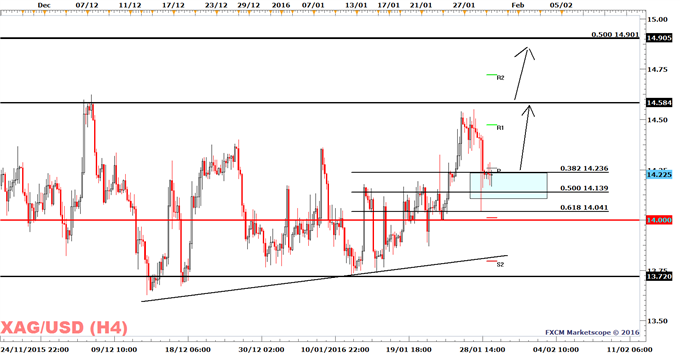

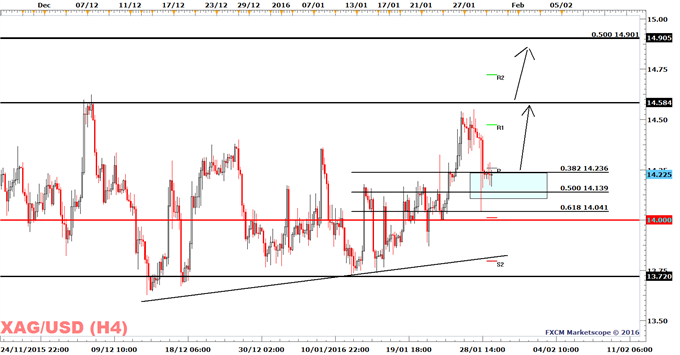

Silver prices had given up near to 50% of their gains from the rally which started on January 12 and the $13.72 level. While I anticipated a decline in yesterday’s outlook, the current drop is slightly deeper than expected. At this stage it’s hard to attribute the decline to any specific factor and with this in mind I am placing extra emphasis on the technical outlook.

The overall trend is bullish above the January 22 low of $14, and as long as this level holds I anticipate that silver will reach the December 7 high of $14.58.

Using gold prices to predict where silver should be trading, my simple fair-value model suggests that silver should be trading at $14.78, as long as gold prices remain above $1114.

Fourth Quarter GDP on Tap

Several U.S. key reports are on deck, firstly, and most importantly, a Bloomberg poll projects fourth quarter GDP to rise by 0.8% QoQ (annualized). Secondly, the forward looking indicator, Chicago PMI, is projected to rise to 45.3 from 42.9.

Core PCE, and final University of Michigan Consumer Confidence is also on tap, but less important for the market at this stage.

After the Fed struck a dovish tone in at their latest FOMC meeting, my basic assumption is for better than expected data to have a fairly limited positive impact on the Dollar and thereby to soften silver.

Silver Prices | FXCM: XAG/USD

Leave A Comment