Although precious metals are quite weak now, the silver / gold ratio indicates that we are still in a bull market in precious metals:

source: Stockcharts.com

The red arrow on the upper panel of the chart shows gold prices trending slightly down. However, the blue arrow indicates that the silver / gold ratio is going up. In other words, silver is a little bit stronger than gold now and it could be a good time to look at valuations of a few silver plays.

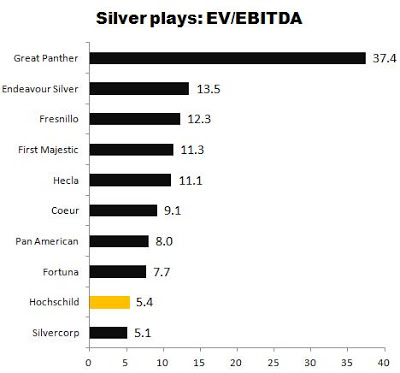

Below I have plotted a popular valuation measure defined as enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA):

source: Simple Digressions

Note: EV/EBITDA calculated for Great Panther and Coeur Mining is based on the results reported in 4Q 2016, 1Q 2017, 2Q 2017 and 3Q 2017; other ratios are calculated taking the results reported in 3Q 2016, 4Q 2016, 1Q 2017 and 2Q 2017

Now, look at Hochschild Mining. In my opinion, this company does not deserve to be valued at 5.4 multiple of EV/EBITDA. Due to excellent performance of the Pallancata mine, the operating results reported in 3Q 2017 were really good. And it looks like next year, when the Pablo vein of Pallancata operates at full capacity, the results should be even better.

In my opinion, Hochschild is a buying opportunity now.

Leave A Comment