With the USD in general retreat and risk-off dominating the stock markets, the demand for haven-assets such as silver and gold has increased.

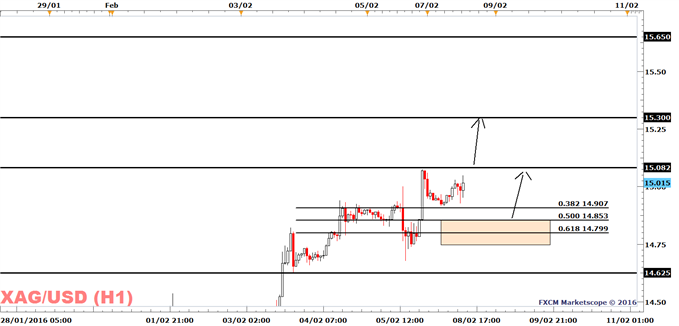

In the case of silver prices, the short-term trend is bullish above $14.62, which is a swing lower from its position on February 3. Traders will most likely see a pullback to the $14.85 to $14.75 range as an opportunity to add to their long exposure, as the risk/reward ratio is good here. The alternative entry is a break to last week’s high of $15.08 which will most likely trigger pending entry orders as well as stop loss orders layered above this high.

The next strong resistance and target level for bullish traders is the October 10 low of $15.65, a target also supported by gold prices. Silver’s correlation to gold suggests that it should be trading at $15.80.

A level more suitable for short-term traders, is $15.35, which is the 61.8% correction to the October high of $16.38.

Silver Prices | FXCM: XAG/USD

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment