The price of Silver (Ticker: XAG/USD) is trading lower for the fourth consecutive session, with the daily low currently residing at $18.69. This sharp turn in Silver prices has materialized after the commodity failed to hold the critical $20.00 handle last week. As Monday trading begins traders should continue to monitor short-term values of support and resistance to determine if prices may decline further, or bounce back off its lows.

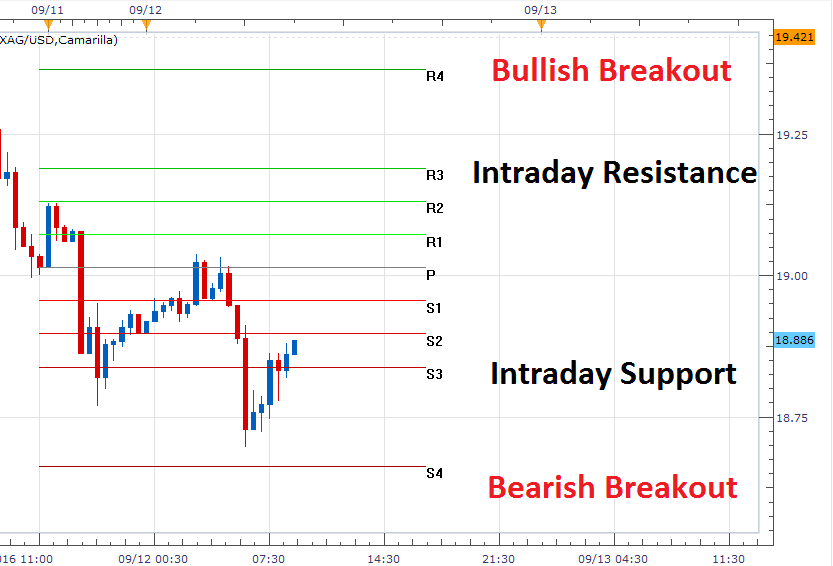

Currently, Silver prices are testing intraday support near $18.83. This value is denoted in the graph below as today’s S3 Camarilla pivot. If prices remain supported here, Silver may bounce back towards the R3 pivot at $19.19. Alternatively, a further decline opens Silver prices to test the S4 pivot at $18.66. A move to this point technically places Silver at new daily lows and exposes monthly lows under $18.57.

Silver Prices 30 Minute Chart & Pivots

Traders looking for a bullish reversal should continue to monitor the R4 pivot at $19.36. Silver. If the price of Silver reaches this point, it would represent the first bullish breakout in the last five trading sessions. In a bullish breakout scenario, traders may extrapolate a 1X extension of today’s trading range to place preliminary bullish targets near $19.72.

Leave A Comment