Silver prices received a boost following a general price rise in metals. Copper, gold and silver prices rose in the aftermath of China publishing their fourth quarter GDP, which printed 6.8% YoY vs. the 6.9% forecasted by a Bloomberg poll, and the pace was the weakest since 2009.

We note that the rise in copper is not in line with what could have been expected. I see this as a general unwinding of short-positions, as bearish bets in copper and the stock market are saturated.

As The Dust Settles, The Range Prevails

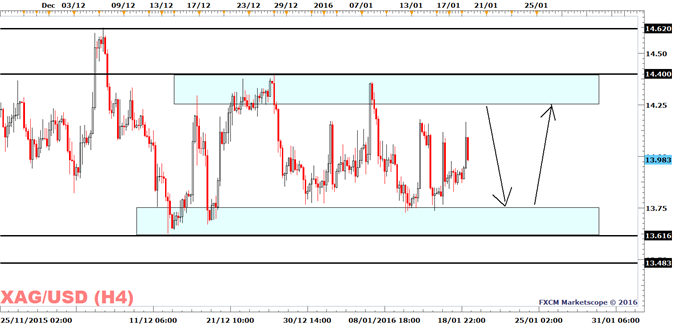

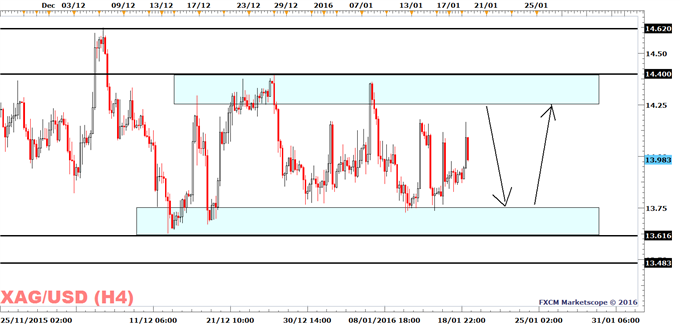

As the dust has now settled, Silver prices remain in a range, and there is little reason to expect a major change in silver prices with no more data on tap today. Range traders will look to use this to their advantage.

Range traders are assumed to buy near the support level at $13.75 with stops below the December low of $13.61. Take profit orders will most likely be placed in the vicinity of $14.25 (near the upper end of the current range). If and when price reaches $14.25, the same traders will probably short with stop loss orders above the December 28 high of $14.40.

Macro traders and trend-followers will wait for a break to the December low of $13.61 given that the longer-term trend is bearish. The macro-outlook is also bearish as the Fed projects a raise to its Fed Fund Rates in 2016, which should in turn underpin the Dollar.

Silver Prices | FXCM: XAG/USD

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment