The much awaited Jackson Hole speech by the Fed Chair Janet Yellen – and the subsequent nonfarm payrolls data failed to ignite the prospects of a rate hike this September of 2016. The market now forecasts only a 21% probability of a rate hike in this month, according to the CME FedWatch Tool. The probability of a rate hike in December of 2016 stands at just above 50%.

Time and again, I have explained why the Fed cannot hike rates in 2016. Contrary many market experts, my view has stood the test of time and has come to fruition. According to my research, the chances of a rate hike in December of 2016 are also very bleak. Nonetheless, the Fed speakers will continue to “jawbone” the dollar, the way they have been doing for the whole year.

The coming week has a number of Central Banks competing with each other to unleash their monetary easing plan as if that is the only solution to all the economic problems plaguing the world. Even the failure of the past seven years has not deterred them from printing more money from thin air.

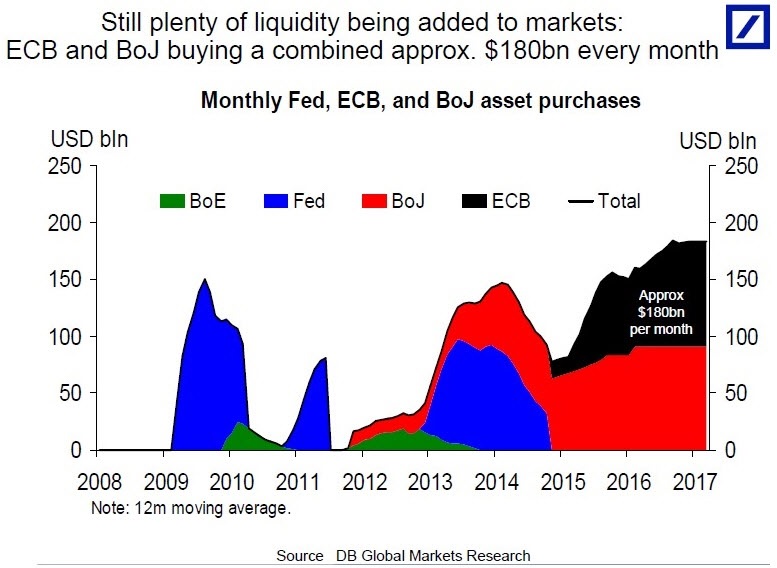

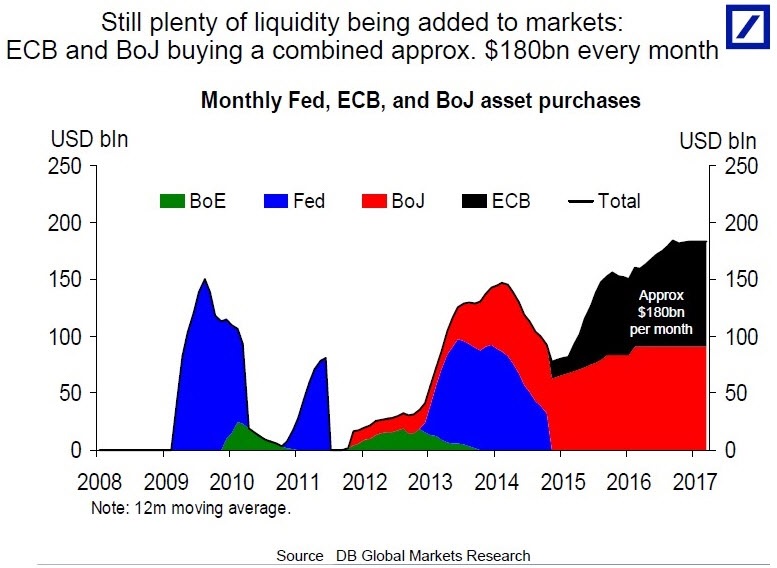

$180 Billion Of Bond Buying – Even Larger Than 2009

The European Central Bank and the Bank of Japan combined are purchasing a whopping $180 billion of bonds monthly, as shown in the chart below. Add to it, the new bond-buying program announced by the Bank of England, and the number rises even higher. All three are expected to recommend either adding to their existing bond purchases or extend their duration in their next policy meetings.

This has led the Bond King Bill Gross to warn investors of the dangerous consequences. In a letter to clients, he wrote: “Investors should know that they are treading on thin ice”.

“This watch is ticking because of high global debt and out-of-date monetary/fiscal policies that hurt rather than heal real economies. Sooner rather than later, Yellen’s smooth shot from the fairway will find the deep rough,” reports CNBC.

Silver Is On The Cusp Of A Massive Rally

Leave A Comment