The Dropbox (DBX) IPO is well-trod ground at this point. The deal is expected to price on 3/22 and open for trading Friday, 3/23. The company raised the range to $18-20 so we are using the $19 mid-point in our analysis.

To add to the general pomp and circumstance, Salesforce (CRM) stepped up to buy $100M of the deal at the IPO price. Here are some of the key points that appeal to investors:

Putting the basics together in our first cut analysis suggests a $27 potential IV for the shares post IPO. After what we saw with Zscaler (ZS) last week maybe DBX shares will get there.

Challenges

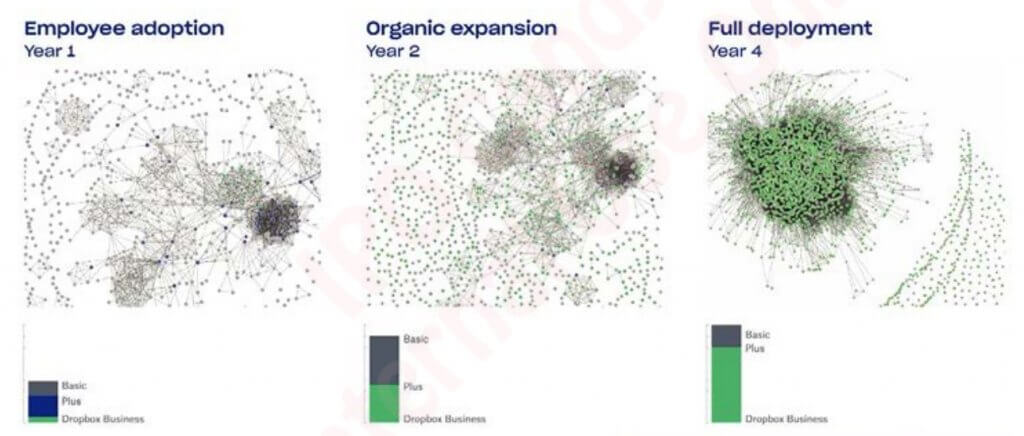

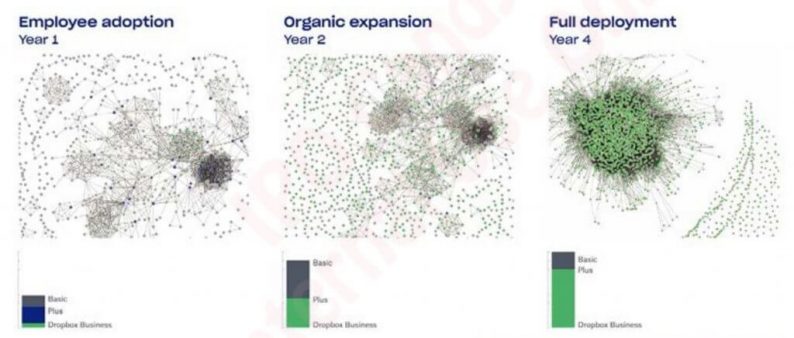

Yet there are some reasons to be uncertain of their future success. They have done a great job of using a “bottom-up” strategy to capture the consumer and SMB market for a cloud-based file system that handles backup, synchronization, and sharing of files.

But going forward the growth of Dropbox will depend on being able to make some big changes:

None of these are trivial and they are likely to impact the financial model as well. For example, much has been made of their low relative cost of sales. That will change as the company goes after larger customers.

As they move into teams and workflow their position relative to their partners and competitors will change along with it. Sure Salesforce (CRM) is a partner and is making an investment on the IPO. That’s good news.

But other companies like Slack, Microsoft, Google and Atlassian (TEAM) that view Dropbox as a partner today might not see things the same way if Dropbox strategy is based on launching products that compete directly with these companies.

Leave A Comment