If there’s one area of the market that investors couldn’t be more bearish on, it’s the multi-line retailers. With Amazon eating their lunch, consumers changing the way they spend money (choosing experiences over stuff), and an overall bloated retail footprint, multi-line retailers have faced a perfect storm and their stocks have reacted accordingly. With all the negative headwinds, short-sellers have been piling on the group.

At the end of 2016, average short interest as a percentage of float for the group was an already high 14.3%, but through the course of the year, short interest levels ballooned to more than 25%. Shorting retail stocks has become one of the consensus trades of 2017. The trade has become so consensus, in fact, that ProShares imitated (to put it kindly) our Death by Amazon Index and created an ETF that increases in price when the stocks of traditional brick and mortar retailers decline.

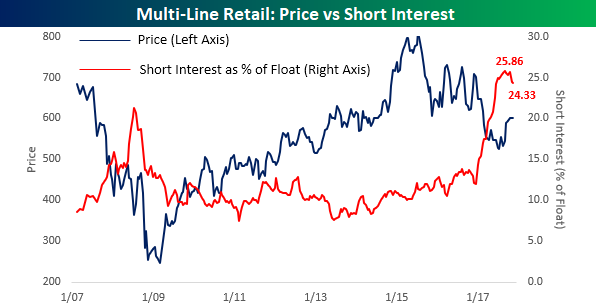

In recent weeks, however, we have begun to see some easing in the pressure by short sellers towards traditional brick and mortar retailers. The chart below compares the S&P 500 Multi-Line Retail Index to the average short interest (as a percentage of float) of multi-line retailers in the S&P 1500. While the average SIPF level of stocks in the group peaked at 25.86% at the end of August, in four of the last five short interest reports, the average has declined. Granted, it’s not much of a drop and it has coincided with a rally in the stocks, but it’s the first time we have seen such consistent declines in short interest for the group all year.

Leave A Comment