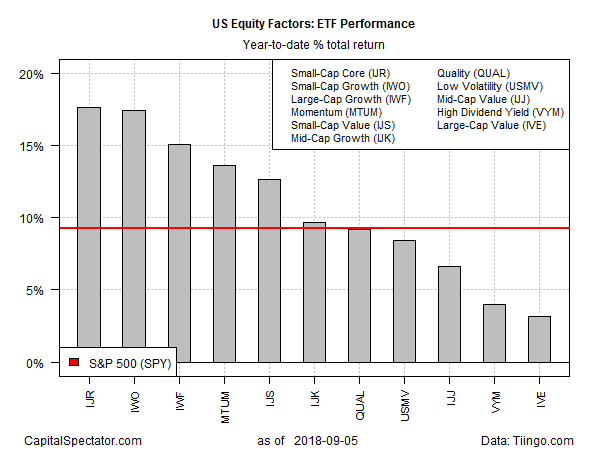

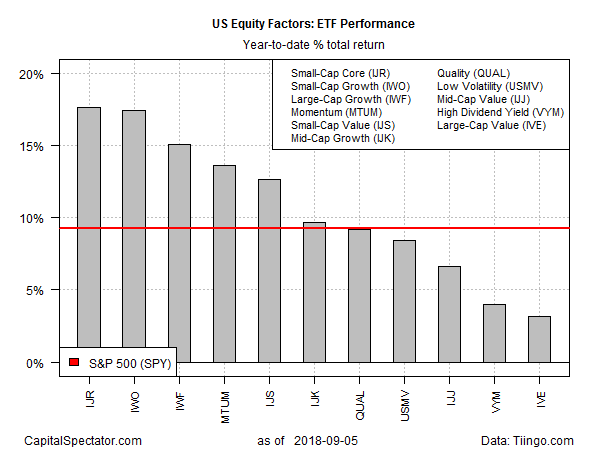

Year-to-date returns for US equity investing are still dominated by small-cap and growth factors, based on a set of exchange-traded funds (ETFs).By contrast, large-cap-value stocks are currently posting the weakest gain so far in 2018 among the main equity factor buckets.

At the front of the factor horse race is a broad small-company fund: iShares Core S&P Small-Cap (IJR), up a sizzling 17.7% so far this year through Wednesday’s close (September 5). Although the ETF has eased in recent days, it’s still close to an all-time high.

Nipping at IJR’s heels: a small-cap ETF with a growth bias. The second-strongest factor performance year to date is found in iShares Russell 2000 Growth (IWO), which is posting a 17.4% total return so far in 2018.

Large-cap growth stocks are in third place. The iShares Russell 1000 Growth (IWF) is ahead by 15.1% this year.

Wallowing in last place: large-cap value stocks: iShares S&P 500 Value (IVE) is posting a relatively weak 3.2% total return in 2018 through yesterday’s close.

For context, note that the broad US equity market – SPDR S&P 500 (SPY) – is up 9.2% this year.

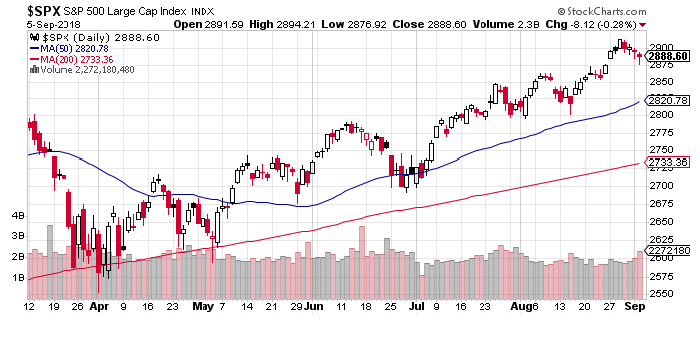

Although stocks in the US have been outperforming the other major asset classes in recent history by a wide margin, some analysts still see another leg up for equities. A key factor that hints at more gains: a strong manufacturing sector, advises Tony Dwyer, equity strategist at Canaccord Genuity. Writing in a recent research note, he predicts the S&P 500 Index (currently at roughly 2889) will rise another 11% to 3200 by the end of the year.

“The Institute for Supply Management showed that the manufacturing sector remains on very solid ground,” Dwyer advises “History shows that since 1950, the ISM typically peaks well before the economy enters recession or the S&P 500 hits the cycle high, especially over the past three levered economic periods.”

Leave A Comment