Small Cap Earnings estimates have been going down, but why?

PIX1861 / Pixabay

You either love or hate small caps. Small caps can offer better returns than their large cap peers, but these returns come with a trade-off — you need to make sure your research is watertight. Small caps are risky, and companies that successfully move from the small to the large cap leagues are rare.

Unfortunately, researching small caps is almost as tough as trying to pick winners. Wall Street is well-known for its optimistic approach to calculating earnings growth and price targets, and as it turns out when it comes to small caps, analysts are predictably overoptimistic.

Small Cap Earnings Estimates

In a recent blog published at the end of last week, Eric Newman chief investment officer at TFS Capital LLC took a look at how Wall Street earnings expectations for small cap stocks develop over the course of each calendar year. As over 80% of the companies in the Russell 2000 index have a fiscal year running from January 1 to December 31, at the end of the calendar year the Wall Street consensus Russell 2000 earnings estimate is backward looking, and when the clock ticks past 24:00 on December 31, the average estimate becomes forward-looking.

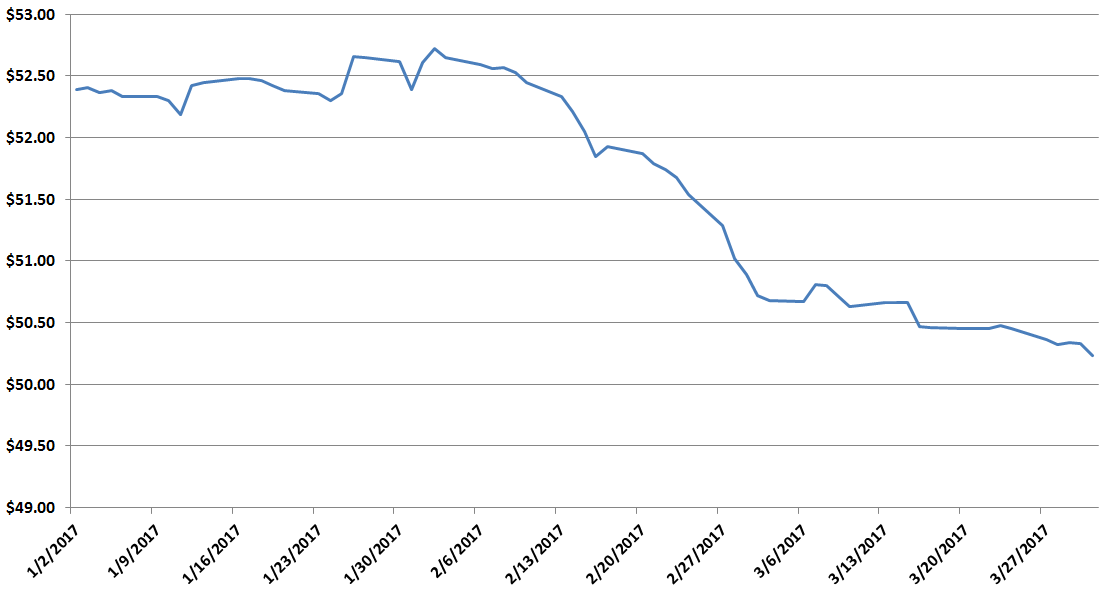

This jump from historic to forward-looking earnings is bound to have a positive impact on the earnings estimate (unless aggregate earnings are set to contract year-on-year). Indeed, at year-end 2016 analysts were expecting total earnings per share of $42.88 for the current fiscal year, jumping to $52.39 for the year ahead when January 1 rolled around. What is fascinating however is the fact that over the past three months as the Russell 2000 index gained 2.5%, the consensus earnings per share estimate for the index fell 4.1%.

This revelation is, in itself not all that surprising. Analysts are known to be overoptimistic and as the year progresses we can assume earnings estimates are refined based on trading conditions so are more than likely to tick lower. Nonetheless, as Eric highlights in his blog post every year since 2011, analysts have forecast substantial earnings growth for small cap stocks and then every year, as the year progresses, analysts have gradually trimmed forecasts.

Leave A Comment