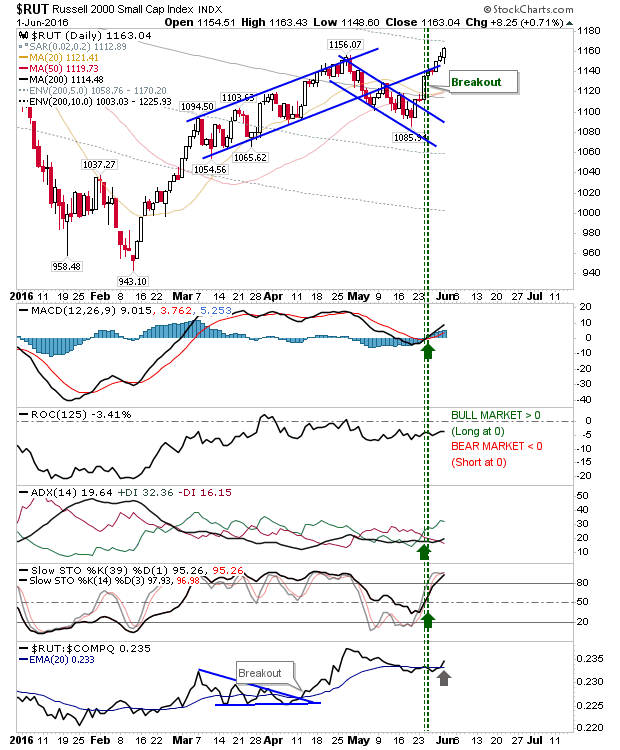

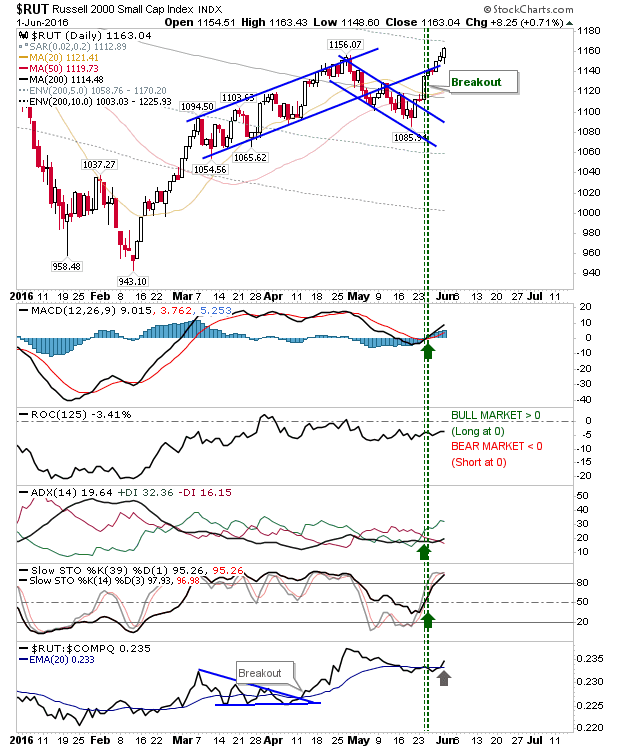

The Russell 2000 pushed on to clear April’s swing high as relative performance swung back in small Caps favor over Tech Indices. The index was the clear winner in what was a quiet day for other indices. There was also a ‘Golden Cross’ between 50-day and 200-day MAs.

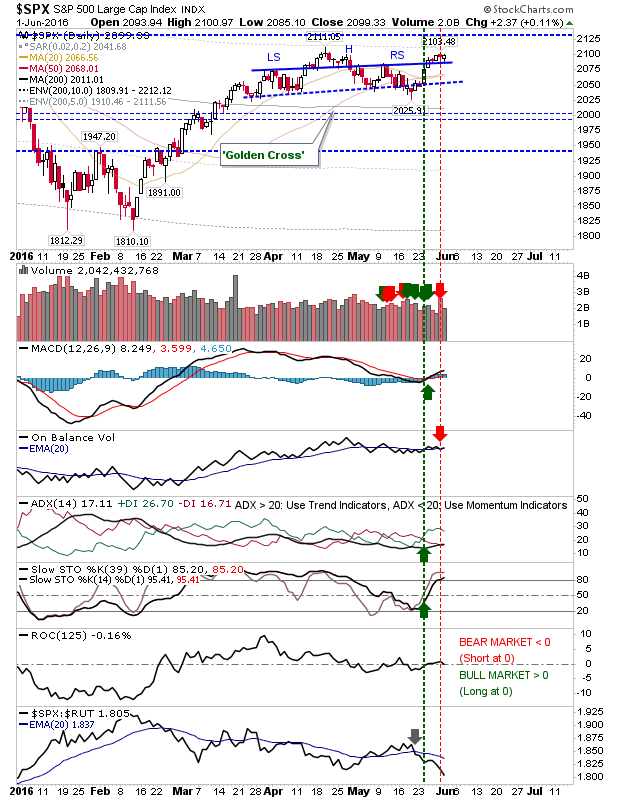

While Small Caps registered new highs, the S&P kept pressure on negative the head-and-shoulder pattern. Today saw gains, but not enough to deliver the new highs seen in Small Caps. Large Caps have struggled since mid-May in keeping pace with Small Caps, but this is bullish for the wider market as money rotates into more speculative stocks.

Running between Small and Large Caps are Tech averages. The Nasdaq also posted a modest gain and remains below April’s high. It has, however, out-performed the S&P from mid-May. And with two accumulation days over the past 7 days it is enjoying a rebound in long term buying.

For tomorrow, continue to look to the S&P and Nasdaq to follow Russell 2000 action and post new 2016 highs. Shorts do not have much to work with, as 2015 highs are the next realistic area to challenge.

Leave A Comment