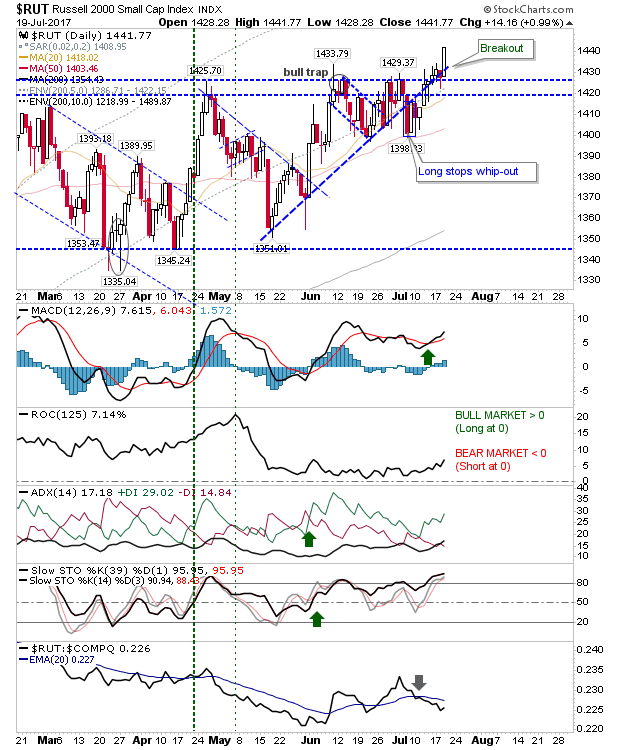

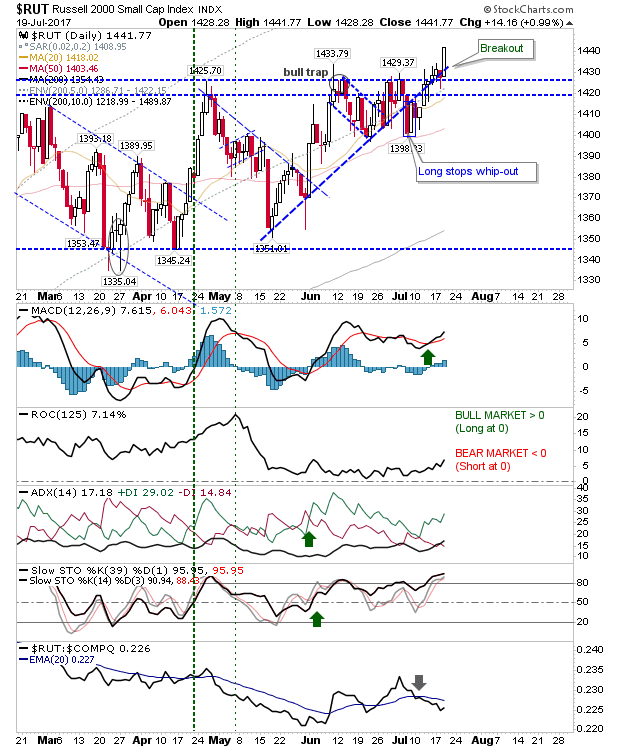

It has taken a few days for Small Caps to make their move but today was the day the Russell 2000 joined other indices in mounting a breakout. It was a clean breakout supported by positive technical strength – putting to bed the June ‘bull trap’. Watch for the second round of stop-whips with an intraday move (and recovery) below 1,430.

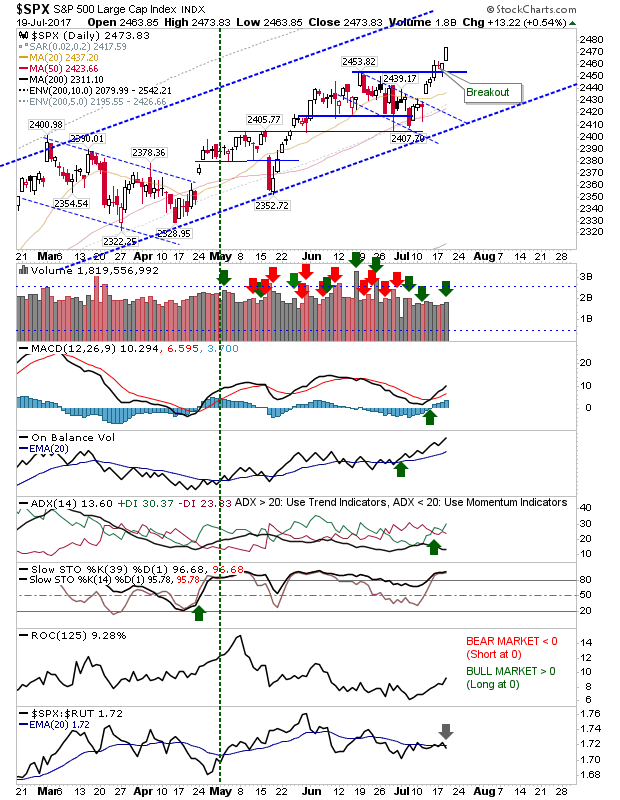

Other indices added to their breakouts. The S&P gapped and pushed on, backed by higher volume accumulation. Watch for a tag of upper channel resistance.

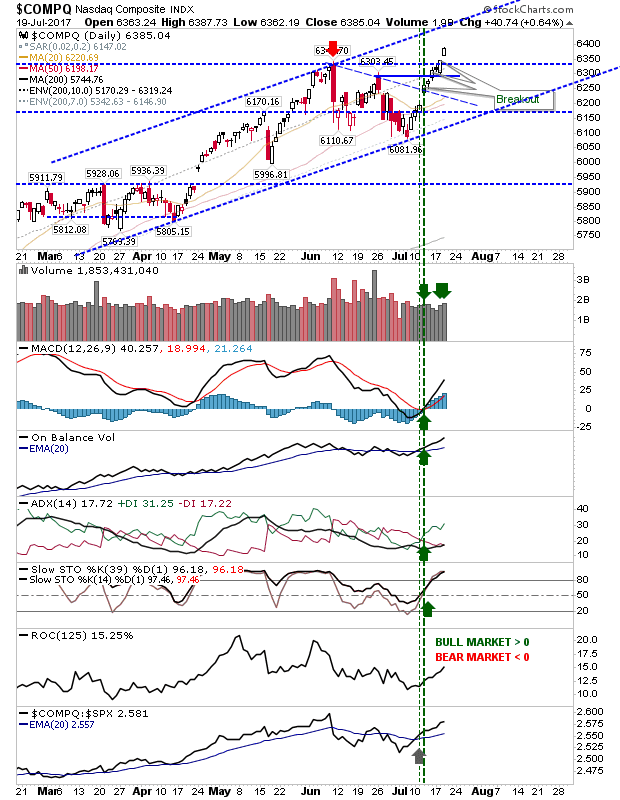

The Nasdaq gapped higher on higher volume accumulation. Today’s move puts some distance on the early June bearish engulfing pattern. As with the S&P it’s looking for a move to upper channel resistance.

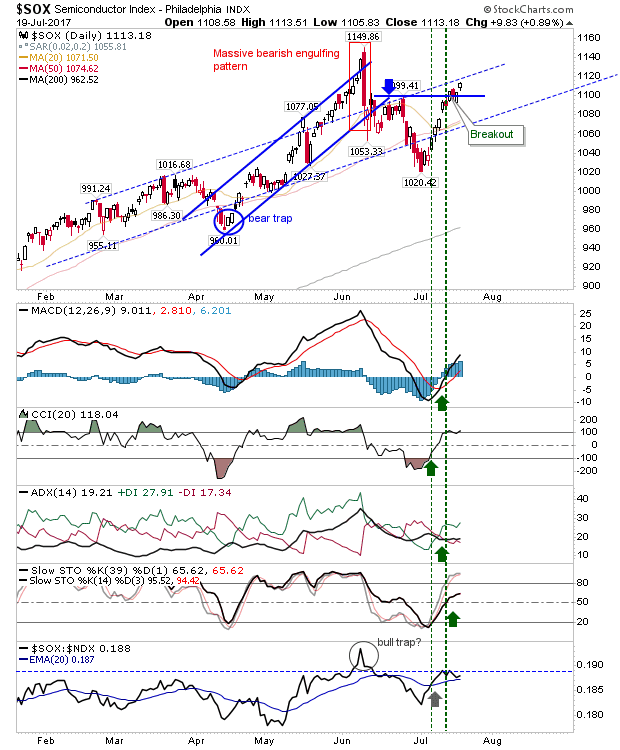

The index most under pressure is the Semiconductor Index and it has yet to fully challenge the June bearish engulfing pattern. However, with the Russell 2000 breaking today it’s now the only index not to challenge (and therefore is offering a ‘value’ opportunity).

The remainder of the week will be about protecting the breakouts. The value index does look to be the Semiconductor Index with the July swing low looking more and more like a significant bottom for the index.

Leave A Comment