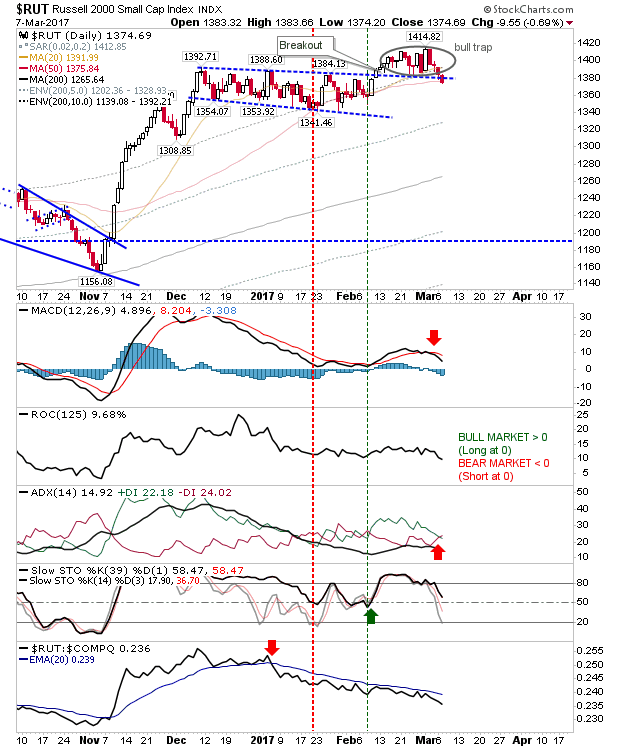

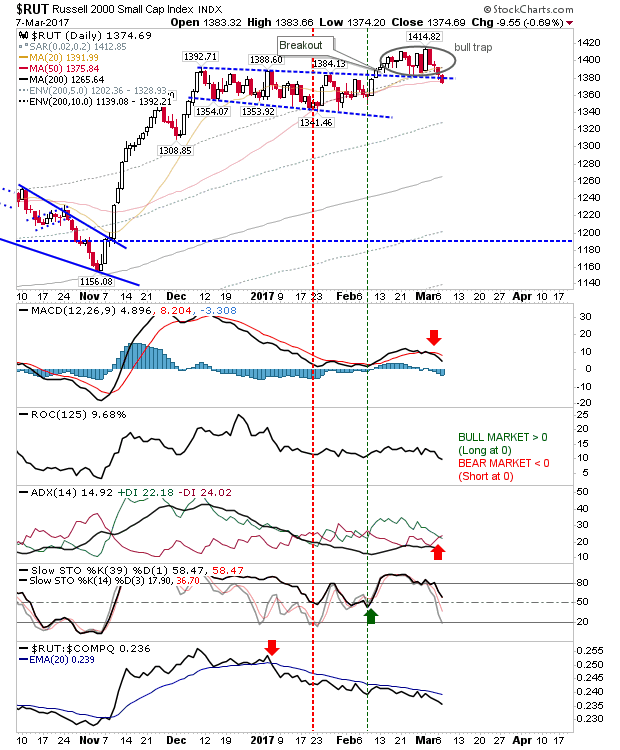

It was another quiet day for most indices, but the Russell 2000 dropped into a potential ‘bull trap’ situation. The Russell 2000 experienced further weakness with a ‘sell’ trigger in the +DI/-DI with Slow Stochastics [39,1] just above the bullish midline – now the last line defense of the net bullish picture for this index.

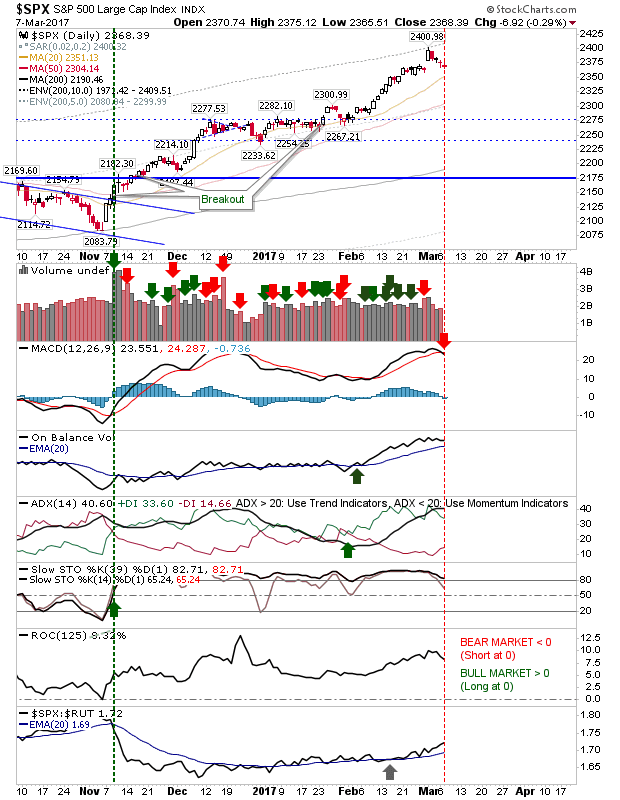

The S&P suffered small losses, but it did close with a MACD trigger ‘sell’ – the first such turn to weakness in supporting technicals.

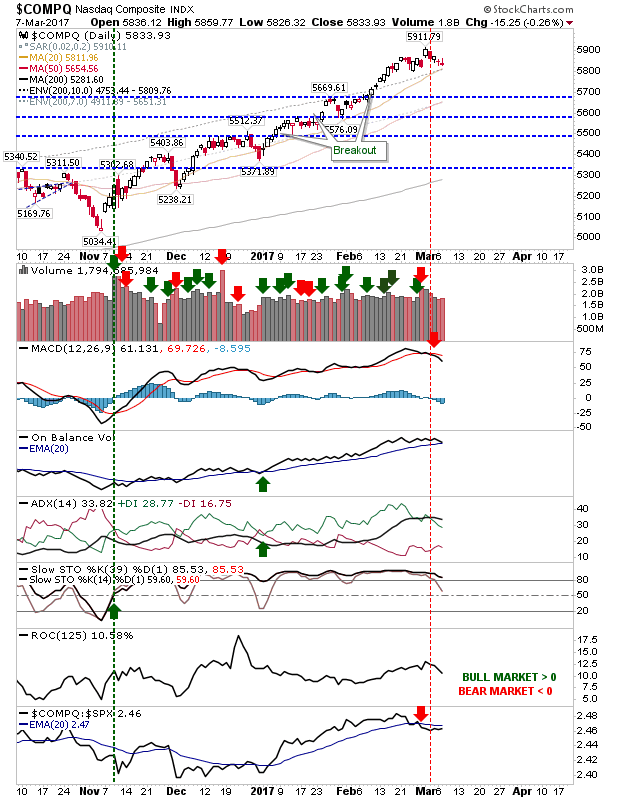

The Nasdaq also finished with a doji (like the S&P), but it’s just above its 20-day MA in what could be a retracement buy opportunity – despite the ‘sell’ trigger in relative performance against the S&P, or the MACD trigger ‘sell’.

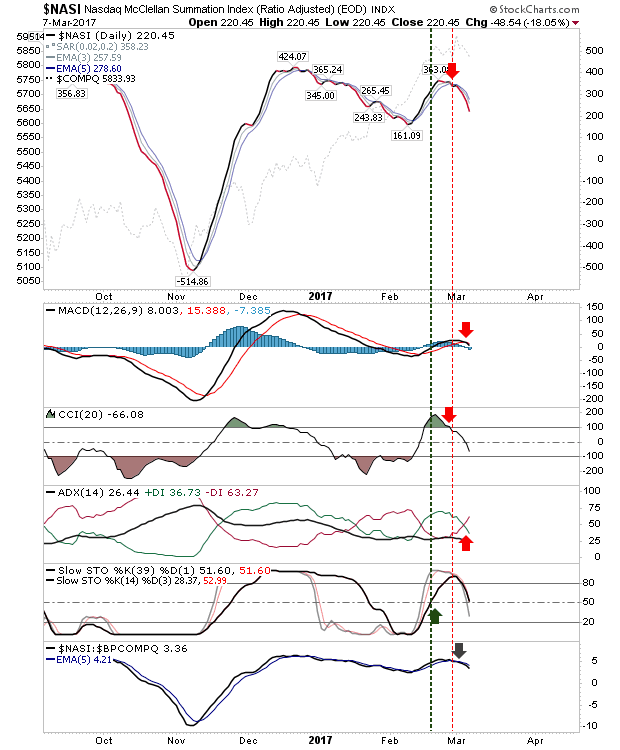

After the Percentage of the Nasdaq Stocks above the 50-day MA turned net bearish on Friday, the Nasdaq Summation Index is getting close to doing likewise – likely tomorrow. This will further pressure Nasdaq bulls.

Further selling on Wednesday will likely force the Nasdaq into a net negative bearish trend as supporting breadth metrics feel the pain. The best long term (short) opportunity will likely come from rallies in the Russell 2000, but the Nasdaq and Nasdaq 100 could also benefit.

Leave A Comment