Yesterday I ripped Blue Apron (NYSE: APRN), which is imploding only a few months after its IPO.

I’m angry that the IPO ever occurred.

The same goes for the Snap (NYSE: SNAP) IPO.

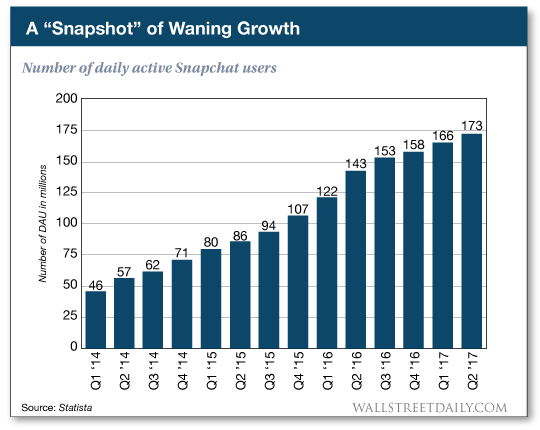

Snapchat’s viability as a social media platform is quickly waning.

The supposed “heir to the throne” of social media managed to grow its subscriber base by only 4% in the latest quarter.

Shares have been in free fall since IPO-ing in March, and the collapse should only continue from here.

Need more proof? Gladly!

Here are three ticking time bombs buried deep inside of Snap.

No Moat Equals Certain Death

For thousands of years, the world’s most crucial castles were protected by moats.

In today’s technology business climate, lack of an economic moat will likely doom a firm.

If you’re unfamiliar, an economic moat is simply a business’s ability to maintain a competitive advantage over its rivals.

Take America’s infamous FAANG (Facebook, Apple, Amazon, Netflix, Google) companies, for instance.

All of these technology firms have a substantial protective ring around their businesses.

An upstart online retailer is going to have a whale of a time building out a platform to combat Amazon. That is, if it isn’t scooped up by the online shopping behemoth first.

Rival Samsung has been eating away at Apple’s smartphone market share for years.

But Apple’s ability to maintain premium pricing power over cheaper Android phones lets shareholders sleep soundly at night.

And after Yahoo was acquired by Verizon, only Microsoft’s Bing offers any kind of challenge to Google’s search engine supremacy. If you could call Bing a real rival to Google. (SPOILER: It’s not.)

So what about Snap’s moat?

Well, the app is quite popular among millennials and the Gen Z population. But all of its most popular features — disappearing messages and stories — have been successfully cloned by Facebook and Instagram.

Leave A Comment