Written by StockNews.com

Snap Inc. (NYSE: SNAP) has seen…[significant] share price gains since its debut last week, but most of Wall Street isn’t buying it one bit.

Over the weekend, Barron’s published a heavily bearish exposé, noting the company’s valuation simply isn’t supported by any fundamentals:

Snap investors better be more patient than Snapchat users. The company’s shares look ridiculously valued after surging 59% to $27 from an initial public offering price of $17 on Wednesday, giving the company a market value of $37.8 billion. That’s a stunning 93 times its 2016 revenue of $405 million. The parent of Snapchat, a popular instant-messaging service, isn’t expected to be profitable until 2019 or 2020.

The piece also noted it would be difficult to justify even SNAP’s $17 IPO price, let alone the lofty heights it’s risen to since then.

Now just this morning, Needham & Co.’s Lauren Martin chimed in with a bearish call of her own. She rates SNAP an Underperform with a $19-$23 price target range.

“Sometimes lottery tickets pay off,” Martin noted, but there are so many risks that the stock doesn’t make sense at current levels.

The analyst cited many concerns with the company, including:

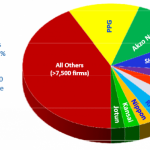

1) Snap’s total addressable market is 80% smaller than Facebook’s

2) Snap already has 50% penetration of said total addressable market in the U.S.

3) Her $3.3B revenue estimate in 2019 assumes Snap has a 14-16% share of adjusted digital ad spend then vs. 2% today

4) Even if revenue does grow to that, the share price would decline based on EV/sales ratios for Facebook and Google

5) No clear path to profitability

6) Academic literature suggests poor year one performance.

We also saw several other bearish calls on the stock come out last week on TalkMarkets….such as Snap Inc. Will Plunge All The Way To $10?

Leave A Comment