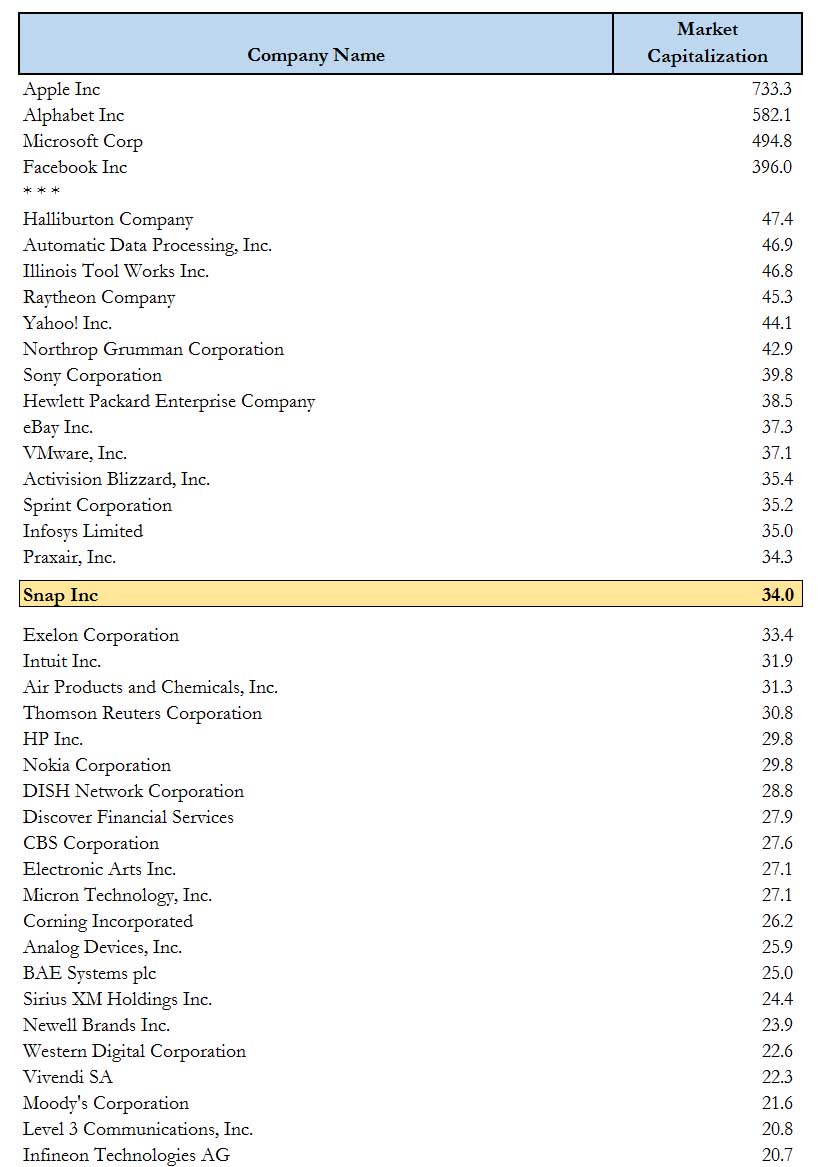

Having priced at $17, Snap Inc. opened for trading at $24, valuing the company over $34 billion – almost three times the size of Twitter, bigger than both HP and CBS, and almost as big as Ebay.

41% jump at the open from the IPO price and extending gains to $25.

Losses greater than revenues make for “hard math to work with” for investors, George Maris, portfolio manager at Janus Capital, says on Bloomberg Television.

At this valuation, Snap is almost three times the size of Twitter ($11.5bn)

Snap sold 200 million shares at $17 each for $3.4 billion, above the initial range of $14 to $16. It was oversubscribed by ten times, according to sources.

As The FT reports, John Colley, a professor at Warwick Business School, said the company faces significant challenges competing with Facebook and Google, makes substantial losses and is suffering from slowing growth.

“Snap Inc is benefiting from institutions and individuals being awash with cash,” he said. “The top end valuation reflects high liquidity rather than a great prospect. There is far more cash than opportunities, which means pursuit of long odds risky options such as Snapchat.”

As a reminder for those who are buying SNAP with both hands and feet…

The company reported revenue of $404.5 million in 2016 and a loss of $514.6 million for 2016, compared with revenue of $57.7 million and a loss of $372.9 million a year earlier.

Snap said it had 158 million daily active users on average in the quarter ended in December, a 48% increase from the same quarter a year before.

If only the company had lost more money!!

Snapchat is expert at burning cash. Free cash flow was $678 million last year. THAT IS MORE THAN ITS REVENUE for the year.

Leave A Comment