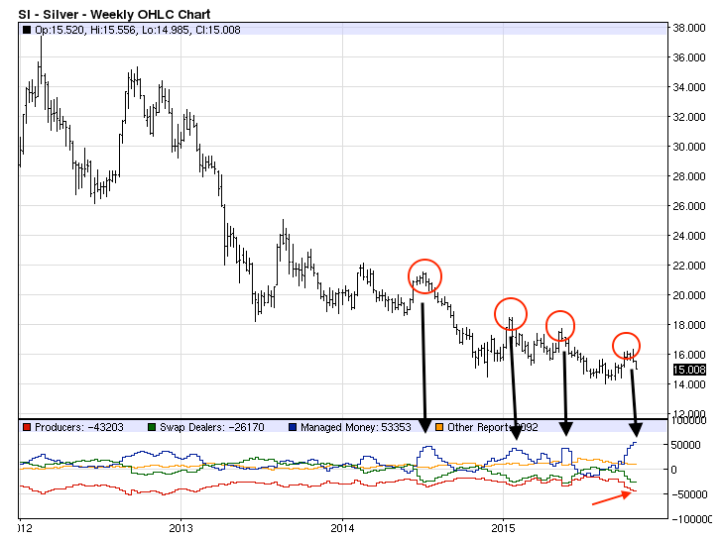

I remember in the earlier stages of the bear market an article analyzing the Commitments of Traders data that broke it down to include the Producers’ activity as part of the ‘Commercial Hedgers’ group.At that time the writer projected a bullish case for gold because well, the Producers were decreasing short positions while the evil bullion banks were responsible for the overall negative CoT alignment.That did not work out well because gold and silver miners are some of the dumbest money on the planet with respect to their hedging history (at important turning points, anyway).

These charts (courtesy Barchart.com) clearly show that it was our friendly silver and gold miners themselves that were pressing the short side into the recent rally while at the same time ‘managed money’ AKA Large speculators, got way over bullish.They are dumb, performance-chasing money too, joining those Wrong Way Corrigans, the miners.Make of it what you will, but this recent unhealthy CoT, leading into FOMC, was aggressively driven by two really dumb forces.The banks were just doing what they usually do.

In more practical terms, the miner hedging may well be involuntary as this sector has become beholden to creditors during the bear market.So I am aware that they may be under hedging pressure from said creditors.But they still tend to be dumb.Gold miners are not traditionally the brightest lights in the constellation of corporate entities.

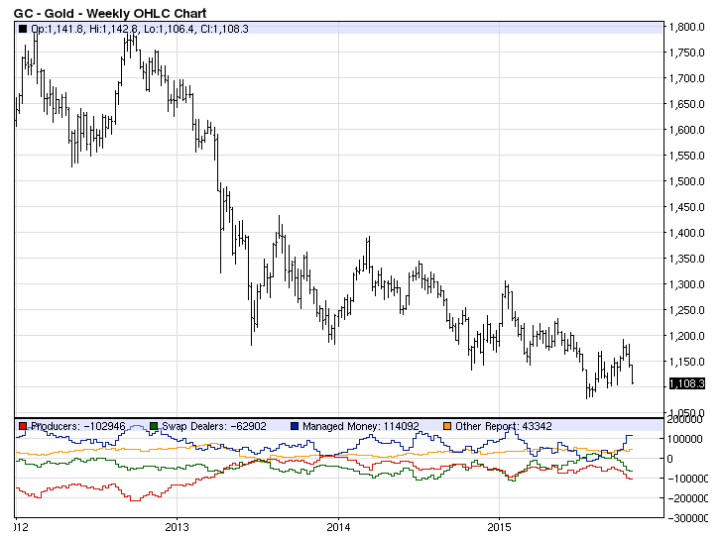

Here’s the gold view…

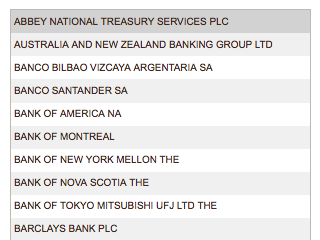

As for the other Commercials, the Swap Dealers, click the graphic for the full list of banks that play that role as recorded at the CFTC…

Leave A Comment