Based on the US dollar index, USD fell by 10% against a basket of currencies in 2017, its worst performance since 2003. Against the euro, the currency fared even worse and fell by more than 12%. Given the mean-reverting nature of currencies, one would assume that the dollar would at least enjoy a relief rally at the outset of 2018. Following today’s Markit Eurozone manufacturing PMI numbers, it looks like the dollar rebound has yet to arrive. Despite the big run-up in EUR/USD, the pair can continue strengthening.

Germany’s significant manufacturing sector underpins the euro

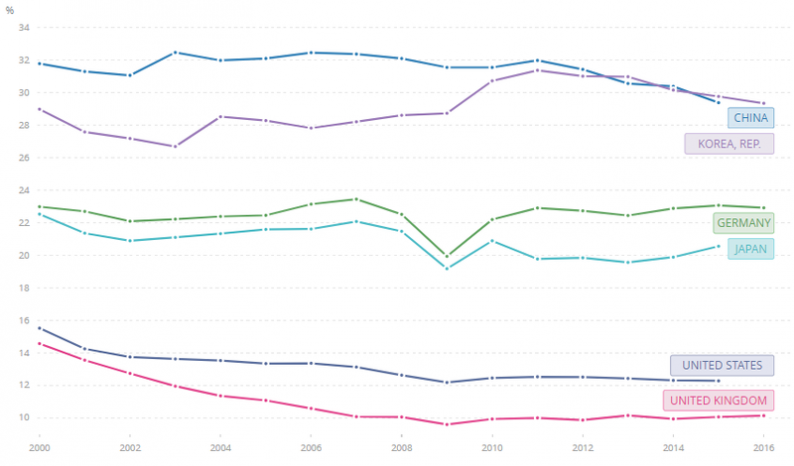

While manufacturing has declined globally (measured as a proportion of overall GDP), the sector plays a significant role in the German economy and also dominates the country’s exports. As the largest economy and exporter in the Eurozone, the health of Germany’s manufacturing industry is a key driver of the common currency. When compared to G20 economies, only South Korea has a greater weighting of manufacturing as a proportion of overall GDP. Countries that operate significant trade deficits, such as the United Kingdom and the United States, tend to be dominated by professional services. This is shown below:

Germany is a world leader in manufacturing

Source: The World Bank; Manufacturing, value added (% of GDP)

As can be seen above, the only large economies with a higher proportion of manufacturing are China and South Korea. Even Japan, long known for its industrial economy, has a relatively smaller manufacturing sector as a proportion of its overall economy.

Beyond its significant scale, German manufacturing is primarily export-oriented. This underpins the euro via significant export surpluses. The trade surplus in goods, by country, is shown below for reference:

Manufacturing drives Germany’s trade surplus

Source: OECD; Trade in goods, net trade (2016)

As can be seen above, Germany has the world’s second highest goods trade surplus (+$300b in 2016) after China (+$494b in 2016). While commodity exporters such as Russia, Brazil, and Saudi Arabia also appear on this list, the size of their trade surplus is much smaller relative to Germany. On the other end of the scale, countries including the United States, United Kingdom, and India operate significant goods deficits.

Leave A Comment