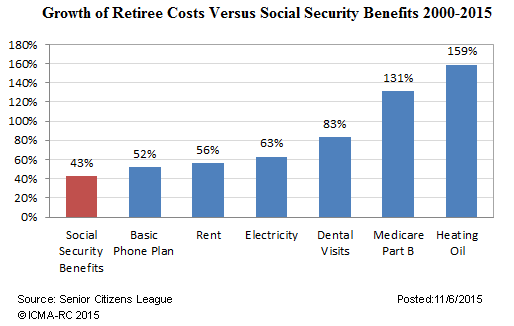

Many retirees receiving a social security benefit know their monthly benefit will not receive a cost of living adjustment in 2016. This is the third time in the last six years where social security benefits did not increase due to the low inflation environment. ICMA-RC recently compared the growth in social security benefits to the growth in some standard costs faced by retirees. As the below chart shows, some of the basic costs retirees face have far outpaced the growth of their social security benefit.

From The Blog of HORAN Capital Advisors

Source: ICMA-RC

As noted in the ICMA article, it is important retirees, and really future retirees, do not put themselves in a situation where social security is their only source of retirement income. Further, retiree investment funds should be invested in a way that provides the opportunity for the funds to grow in excess of the rate of inflation. Even in a low inflation environment basic costs are likely to increase. Additionally, with the Federal Reserve approaching lift off for the Fed Funds rate, a rate increase can have a negative impact on the performance of interest sensitive investments. In a post we wrote in 2013, Chasing Yield Has A Downside When Interest Rates Rise, we detailed the performance of a few categories of interest sensitive assets during a period of rising interest rates. Some investors believe “yield” investments are safer since they pay interest or a higher dividend. As noted in the previously mentioned article, these yield type investments can generate poor returns when interest rates do rise.

Leave A Comment