Business Development Companies, or BDCs, have become popular among income investors, particularly retirees. That is because BDCs, as an alternative asset class, offer very high dividend yields, thanks in part to a favorable tax structure. For example, Solar Senior Capital (SUNS) has a current dividend yield of 8.4%. You can see the full list of established 5%+ yielding stocks by clicking here. Solar Senior’s yield towers above the average stock in the S&P 500 Index, which has a 2% dividend yield. Not only that, but Solar Senior also pays its dividend each month, rather than once per quarter. This allows investors even faster compounding. Solar Senior is one of just 21 stocks that pay monthly dividends. You can see the entire list by clicking here. Solar Senior offers a high level of income, and a way for investors to gain exposure to privately-held companies with the potential for growth.

Business Overview

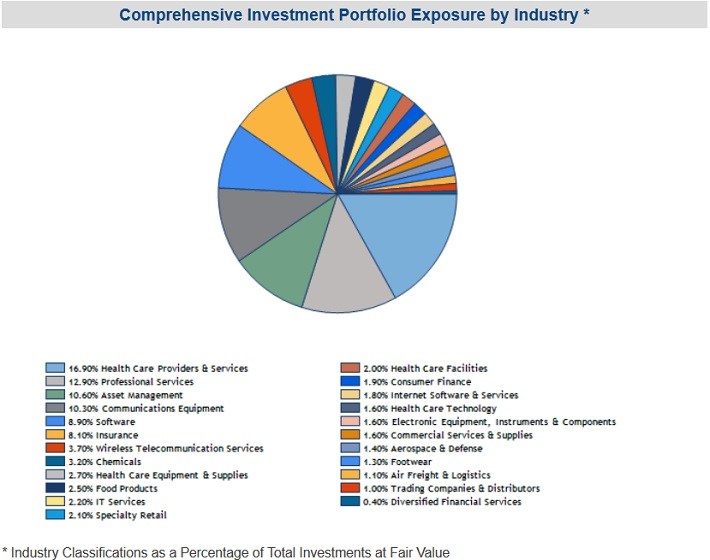

BDCs make debt or equity investments in companies that have not yet gone public, which are typically at an earlier stage of development and require growth financing. They are a way for people to invest in private companies, without having to gain accredited-investor status. Solar Senior Capital is a value-oriented investment company. It invests predominantly in senior secured debt of privately-held middle market companies. As of the end of the 2017 first quarter, Solar Senior had a $373 million investment portfolio. The portfolio is 97% floating rate. It has a diverse portfolio, consisting of 54 companies spanning 23 industries.

Source: Investor Relations

In general, Solar Senior prefers to invest in defensive, non-cyclical industries. Not surprisingly, health care makes up the largest individual industry with 18% of Solar Senior’s investments. Next is professional services, with 13% of the portfolio, followed by asset management and communications equipment, at 10% each. At the end of last quarter, Solar Senior had an average exposure of $8.2 million, or 1.9% to each investment.

Leave A Comment