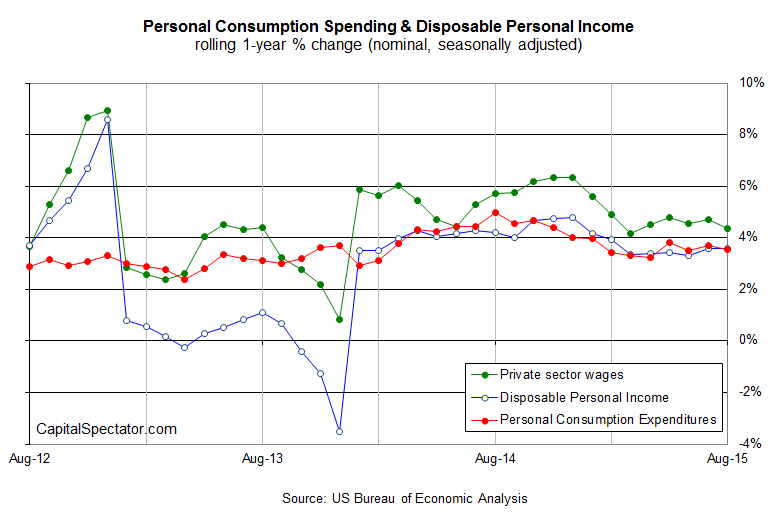

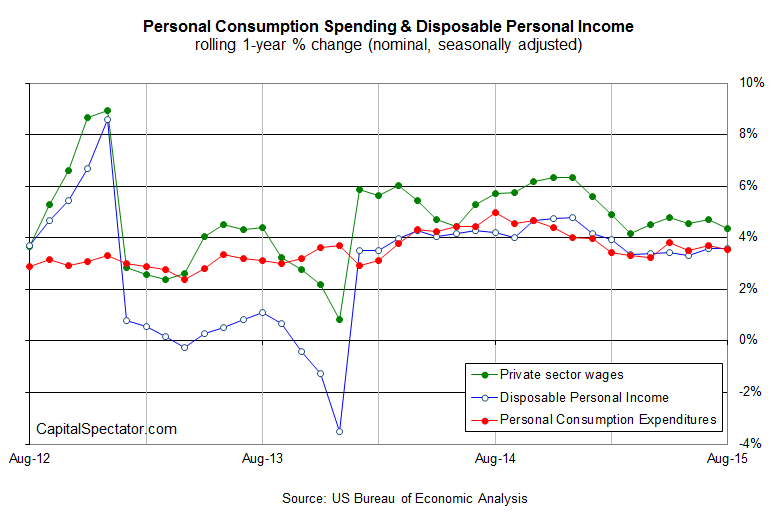

Consumer spending and disposable personal income—money available to spend or save after taxes—posted healthy increases in August, according to this morning’s update from the US Bureau of Economic Analysis. Personal consumption expenditures rose 0.4% last month, matching July’s gain. Disposable personal income’s (DPI) advance ticked down to 0.4% in August from 0.5% in the previous month, but that’s still an encouraging rate of growth. Meanwhile, the year-over-year gains for income and spending remained steady in the 4% range, suggesting that the consumer sector—the foundation for US economic activity–remains on track to deliver moderate if unspectacular increases in the near-term future.

Today’s news should ease worries that the US economy is on the verge of stumbling. It remains to be seen how the signs of slowdown in the global economy will impact the US macro trend in the months to come. But based on today’s reading of consumer spending and income, August was a relatively upbeat month for this all-important slice of the American economy.

“Today’s number is consistent with a 3 percent consumer spending profile for the third quarter,” Tom Porcelli, chief US economist at RBC Capital Markets, tells Bloomberg. “It’s a very nice pace, to be sure.”

The question is whether the “nice pace” will hold up in September? The trigger for the recent spike in market volatility and downgraded economic projections is partly due to China’s surprise currency devaluation last month. Any signs of blowback for the US will probably show up in September. For the moment, the macro profile for this month is still thin, although the September purchasing managers’ index (PMI) for services still points to moderate growth. Manufacturing activity is weaker, although this sector’s flash estimate for Markit’s PMI in September held steady in moderately positive territory. In short, cautious optimism is still warranted.

Leave A Comment