“At last Treasury yields are rising,” Bloomberg’s Paul Dobson writes, projecting what he imagines might be going through the heads of macro strategists the world over.

“A glance over the latest weeklies suggests many of them are getting really cheesed off with the government bond market [and] JPMorgan is perhaps the most explicit,” Dobson adds, before quoting the bank as follows:

Markets are all over the place. We can’t fully make sense of this line up … The bond rally in particular is out of line with other markets and with how we read the fundamentals.

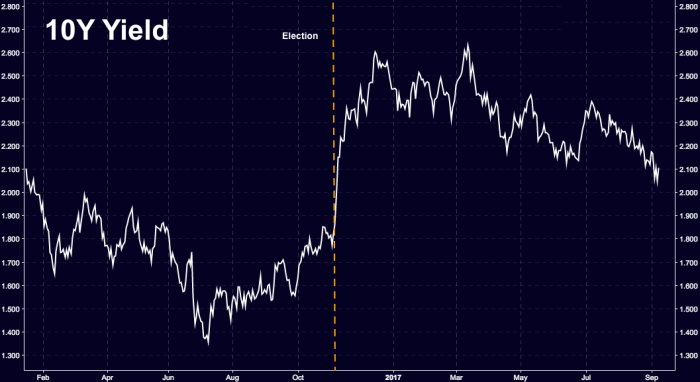

I guess. Although if you kind of step back from your models and just think about the level of indeterminacy around the fiscal agenda in the U.S., think about the fact that Donald Trump is President, think about the lackluster incoming inflation data, and add in a safe haven bid tied to North Korea for good measure, it’s pretty easy to explain 10Y yields below 2%.

And while we’re not there yet, Bloomberg’s Wes Goodman notes that calls for yields to rise from here may not be any more right this time than they have been in the past. Here’s why….

Via Bloomberg

After the U.S. 10-year yield fell to just above 2%, what’s next? It’d be easy to say it should snap back to a range of 2.3% to 2.5%, especially after it jumped at Monday’s open. But that’d be too boring. That’s the consensus view. And keep in mind the consensus calling for higher yields has been wrong for years. Here are the reasons the world benchmark for borrowing costs can drop below 2%.

Leave A Comment