When it comes to the VIX, it is (almost) safe to say that virtually everything that could be said about the market’s record low volatility, its causes, and where it may or may not go from here, has been said. For those blissfully unaware of the market’s mind-numbing complacency and boredom, last week the VIX declined 1.68 points during the week of Yellen’s unexpected dovish turn, and settled at 9.51, the lowest closing level since December 23, 1993 (and third lowest close of all time), while the ratio of VVIX to VIX increased once again to near its 2-year highs. Additionally, 1m and 1y SPX ATM implied vol fell to 7.1% and 13.3% respectively, each two-year lows. Similarly, 1y correlation among the top 50 names in the SPX also declined to a 2-year low.

For the fanatics, here some additional facts, courtesy of BofA:

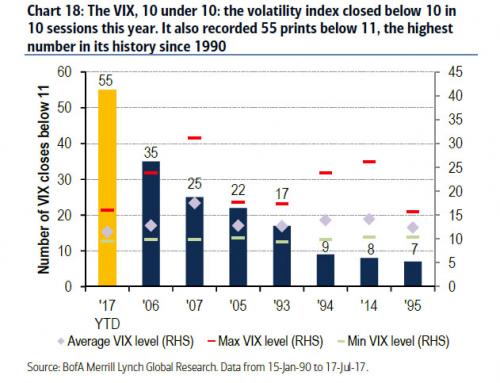

- 1993 had 4 closes below 10

- 1994 and 2007 each had one

What is far less known however, is that as VIX has declined to all time lows, bets on a sudden, violent move – in either direction – have soared. Think VIX “Strangle”

As BofA’s Benjamin Bowler explains, the 30-day moving average of the ratio of VIX and SPX 1m ATM implied vol reached 1.34 on Friday, July 14, above the 99th %-ile (the max was reached on 26-Jun). In other words, it now trades at a never before seen level. This implies that the price of short-dated equity vol convexity is near all-time highs as the premium the market is assigning to owning the VIX over ATM options is at record high levels. These levels are not surprising considering ATM option prices are at all-time lows and put skew is well-bid by investors as the market remains in a “fragile” state.

Leave A Comment