Sony Corporation (SNE – Free Report) reported third-quarter fiscal 2017 earnings per share of ¥228.91 ($2.03), which grew a colossal 1402% from the year-ago quarter figure of ¥15.24, on the back of robust revenue growth.

Inside the Headlines

Sony’s sales and operating revenues were up an impressive 11.5% year over year to ¥2,672.3 billion ($23.6 billion). Solid growth in the Game and Network Services (G&NS) and Home Entertainment & Sound (HE&S) segments as well as positive effect of foreign currency translation spurred top-line growth. The company witnessed impressive performance across its segments.

Additionally, operating income came in at ¥350.8 million ($3,105 million), up a whopping 346.4% from the year-ago quarter. Robust improvement in the operating results of the G&NS, Semiconductors, Financial Services and HE&S segments proved conducive to operating income. Further, the results of the year-ago quarter were adversely affected by impairment charge of goodwill related to the Pictures segment which contributed to the favorable year-over-year comparison.

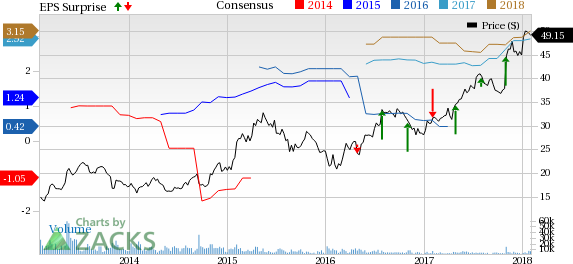

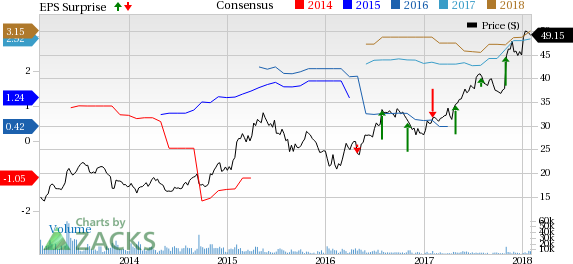

Sony Corp Ord Price, Consensus and EPS Surprise

Sony Corp Ord Price, Consensus and EPS Surprise | Sony Corp Ord Quote

Semiconductor sales and operating revenues jumped 7.3% year over year to ¥250.9 billion ($2.2 billion). Strong sales of image sensors for mobile products and positive effect of foreign currency translation bolstered sales of this segment.

Financial Services revenues advanced 16.9%, year over year, to ¥373.3 billion ($3.3 billion). Increase in revenue at Sony Life and improvement in investment performance in the general account proved conducive to sales growth of this segment. Higher insurance premiums revenue also drove this segment’s top-line.

Moreover, sales and operating revenues of the Imaging Products & Solutions (IP&S) segment climbed 8.4% year over year to ¥181.1 billion ($1.6 billion). Improvement in product mix reflecting a shift to high value-added models and favorable foreign currency movements acted as a catalyst for the IP&S segment.

Leave A Comment