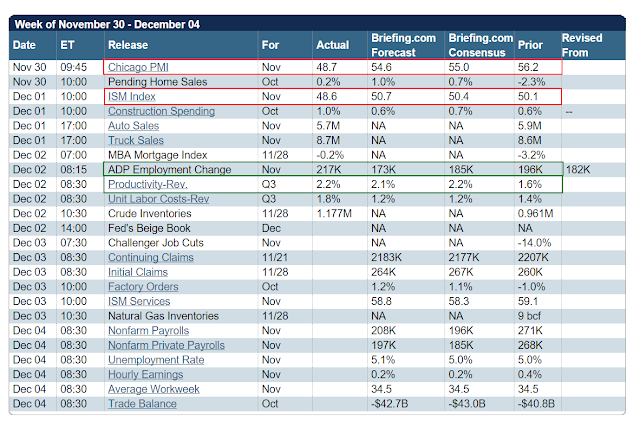

The SP 500 stocks were trading somewhat weakly most of the day, on better than expected ADP employment number and other economic data that looks to provide the Fed with a fig leaf to raise rates this month. And of course on energy market weakness.

The NDX was green much of the day, as techs are near the heart of the latest bubble valuations. There is no good reason for it, other than ‘stories’ in tech carry more credibility with the gullible than pitches that are risibly unrealistic in more mundane areas of the economy.

And then Janet came out in a widely regarded speech today that strongly suggested that ‘now is the time’ for the Fed to increase rates.

Nothing particularly new was said, or done, or learned, but stocks sold off a bit, and went out near the close.

Tomorrow the ECB may surprise us to some extent with QE.

Let’s keep an eye on that.

Have a pleasant evening.

Leave A Comment