The economic data continued in weakly this morning, with an oversized number of newly unemployed, and a continuing unemployment number that was higher than expected. Tra la.

There may be little doubt that the ‘trickle down’ stimulus that has been bloating the paper assets of the wealthiest few while no progress is being made by all the rest is going to lead to a break point in the current socio-economic equilibrium. At least, this is what history has proven.

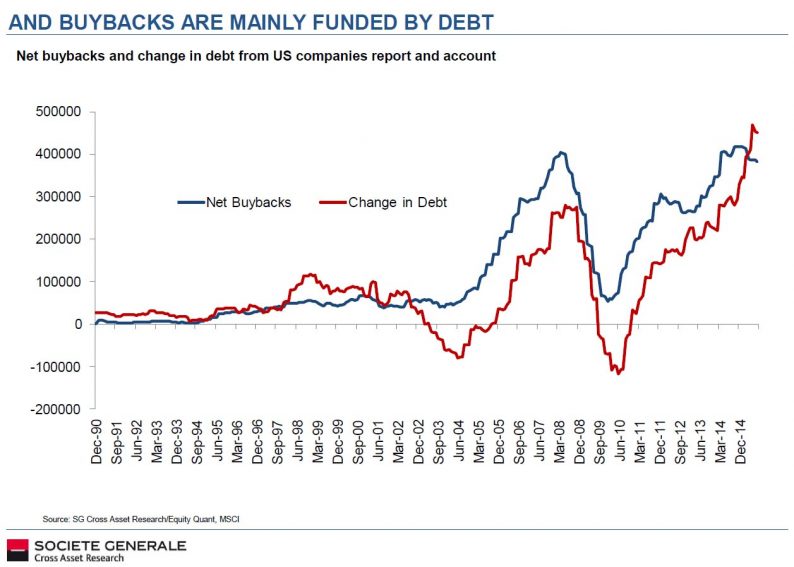

On the right is a chart that shows how the huge increase in corporate debt that has been facilitated by the Fed’s easy money AND generous tax breaks, loopholes, and offshore tax havens for the biggest and the wealthiest corporations, has been largely deployed not to build for the future, or pay living wages, but rather to pump up the price of their stocks through buybacks that benefit insiders and the wealthiest few.

But such abuses of policy and regulation can go quite far. And the further it goes, the more messy the reversion to the mean may be.

So what next for the stock bubble?

It was encouraging that the SP 500 futures stopped precisely on major support. The NDX futures not so much. They have not yet reached down to fill the ‘gap’ that is down around the 4650 mark. The gap is narrow on the futures, but almost yawning on the cash market.

As for the SP 500, it *could* be forming up a W bottom or a cup and handle, depending on where it stops, and if it rebounds. I will address that more explicitly if it happens.

But if it does, that is a tip off that the wiseguys have decided that there is room to ramp the stock indices much higher into the close of the year, for a proper yuletide pig fest, for themselves of course.

So let’s be patient and see what happens. I have taken the volatility long and index short off, as it met my short term criteria. I may have to come back in reluctantly perhaps, but the market will let us know what is unfolding.

Leave A Comment