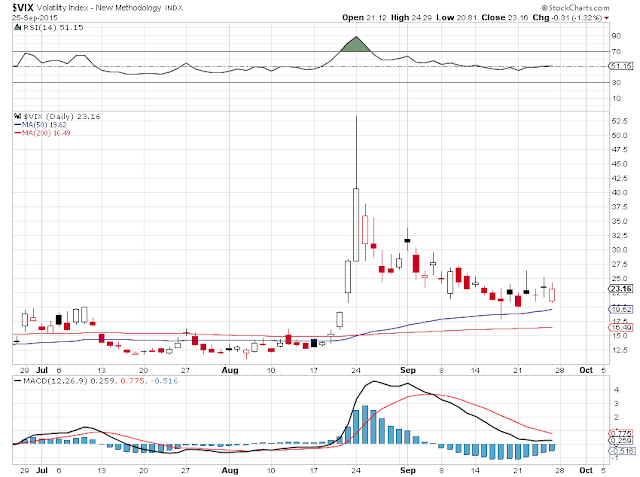

The estimate of U.S. GDP for the third quarter came in higher than expected at 3.9 % versus 3.7% expected. And so stocks rallied, for a while. But the enthusiasm for a recovery faded badly into the late afternoon, as people took stocks of the state of the world, and what they can see with their own eyes: a recovery largely restricted to a few in the ruling class and financial interests, and a global slump of demand.

This passive-aggressive posture towards equities in general and risk in particular is because of the lack of reform to create a sustainable, stable recovery fueled by organic demand for growth based across a broader participation among the consumers.

Leave A Comment