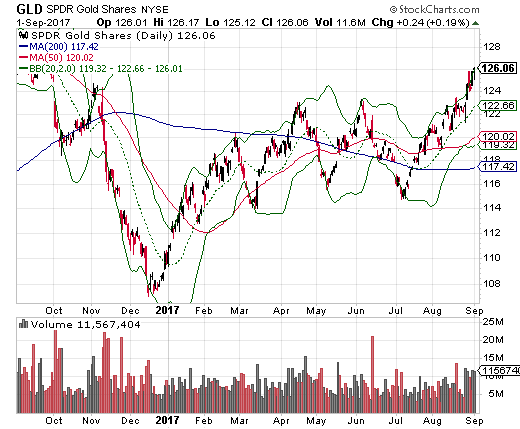

The SPDR Gold Trust (GLD) accomplished a major milestone in the past week: it fully reversed its entire post-election loss in what looks like a major breakout.

Yet one more “Trump effect” put to rest.

Source: StockCharts.com

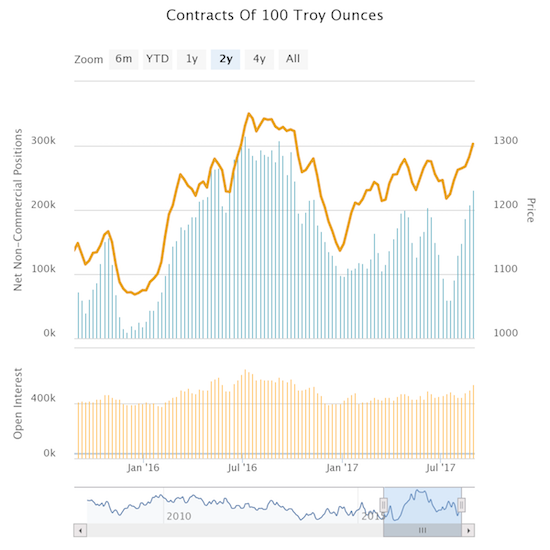

Speculators have been rushing back to gold likely in anticipation of these much higher prices. Speculators have rushed to re-accumulate net long contracts since the last trough in mid-July.

Source: Oanda’s CFTC’s Commitments of Traders

Since 2008, here are the years where a similar rise from a July trough or significant dip have occurred: 2010 (to an October peak), 2012 (to an October peak), 2013 (to an October peak), and 2015 (to an October peak). A seasonal pattern “almost” exists here. While we cannot expect every year to bring a swing from a July dip to an October peak, it sure appears that when speculators buy off a July low, the accumulation continues until October. In other words, I fully expect this bullish run to last until at least October. I also do not think it is an accident that the peak occurs just as the seasonally weak period for stocks comes to an end.

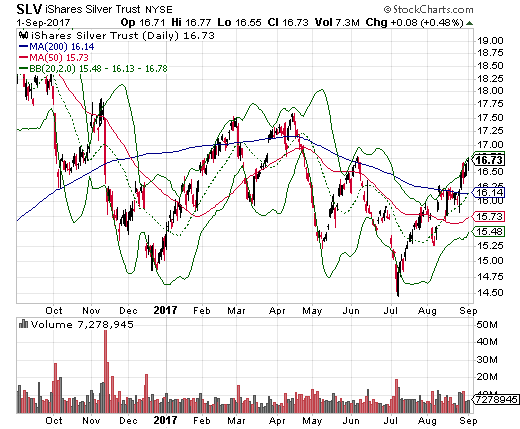

The iShares Silver Trust (SLV) is also enjoying a rebound from a July trough. SLV even managed to break out above resistance at its 200-day moving average (DMA). I sold my last tranche of SLV call options at the 200DMA test. However, SLV has quite a ways to go until it pulls off the same post-election milestone as GLD. Still, I dove right back into some SLV call options expiring in September (to be refreshed with an October expiration if needed) to play the breakout.

The iShares Silver Trust has managed to continue its rebound from the July low with a powerful breakout above 200DMA resistance.

Source: StockCharts.com

Like gold speculators, silver speculators have steadily re-accumulated net long contracts form the July low. Yet the current positioning has only returned to levels last seen in June. Presumably there is a LOT more upside to go here.

Leave A Comment