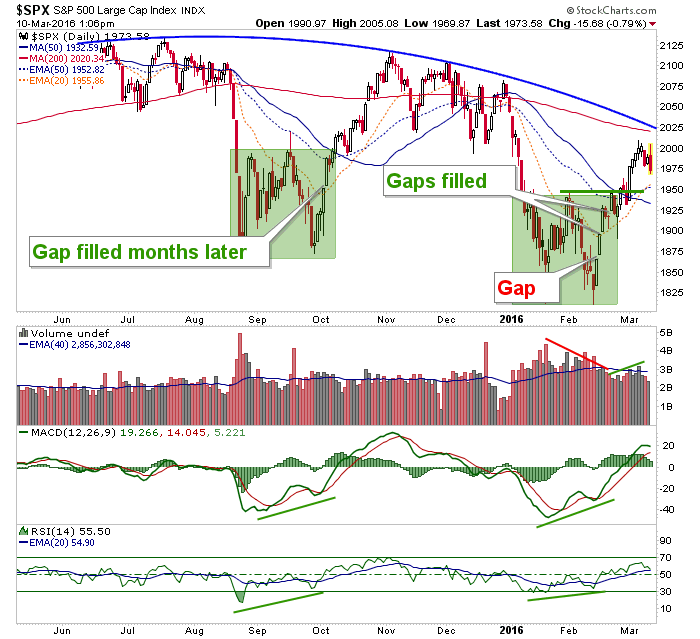

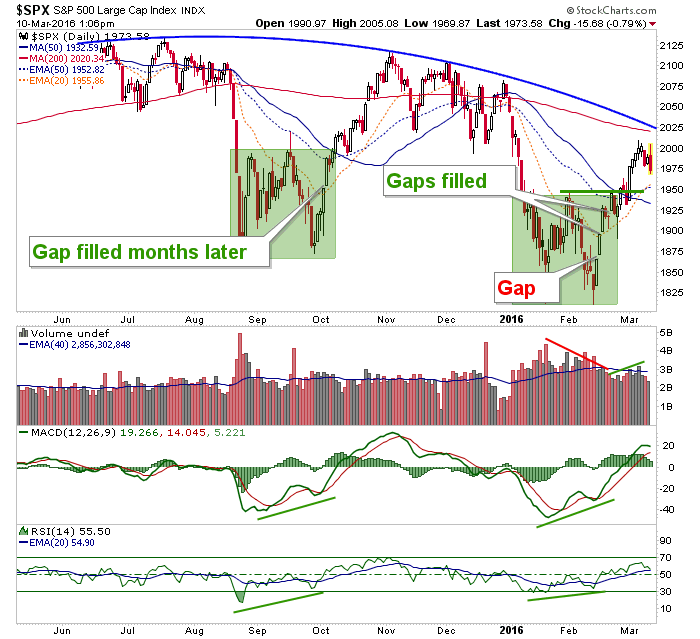

I have allowed for the S&P 500 to rise to 2030 (bounce target: 2000-2030) before starting to even think about a revision of the ongoing intermediate bearish analysis. Today’s post-Draghi roll over is not a positive but it does not preclude the market from getting up to the SMA 200. Either way, there is a gap down there at 1864. Oh, and Dow and NDX each happen to have equivalent gaps still open as well.

There has been so much hype and hope about this bounce that I don’t doubt some people would call that a breakaway gap not needing to fill. But a) it did not happen on high relative volume and b) it did not change a trend. So it is a candidate to fill either from the bottom of the bounce zone (2000) or as is looking less likely, from the top of it (2030).

Leave A Comment