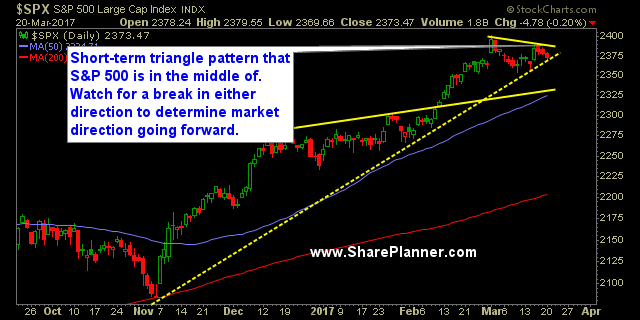

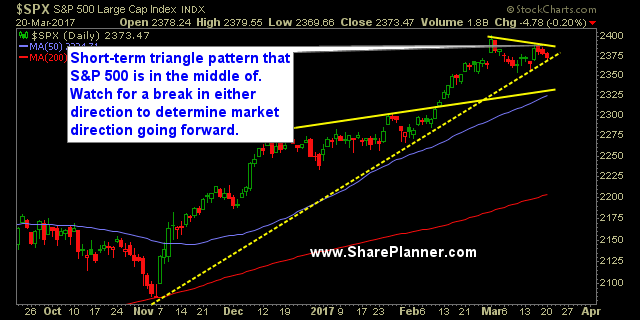

Short-term triangle pattern on SPX

SPX has been coiling in a triangle pattern the past three weeks now, or essentially, this entire month of trading. It has pulled back to the rising trend-line that forms the bottom half of the triangle pattern. However, it has only experienced a mild, light volume pullback over the past five trading sessions, and could easily bounce here and breakout of the triangle to the upside.

Watch for a move in one direction or the other and plan your trades accordingly. These light volume pullbacks that are extremely shallow. Check this out. The S&P has finished down four out of the last five days. On 3/13 SPX finished the day at 2373.47. Yesterday it closed at 2373.47! Crazy, right? Basically, despite the market pulling back 80% of the time during that time frame, it is still at the same place it started. That isn’t a pullback!

Hang tight out there. Don’t get ahead of yourself, and always put the risk first in all of your trades.

S&P 500 Chart

?

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables:

Leave A Comment