You don’t need to be a mathematician to be able to calculate Square, Inc.’s (SQ) valuation. You do need to circle back on your assumptions about whether PayPal Holdings, Inc. (PYPL) provides a good point of comparison. When Square is held up next to PayPal, it shows that though their business models may differ in some ways, they give a good reference. It then points SQ likely undervalued relative to PYPL. However, PYPL itself is overvalued.

A PayPal Comparison

It’s been proposed that PayPal offers a good point of comparison for Square. They both operate as payment service providers that allow businesses to accept payments. SQ hit the scene with their easy-to-use dongle that turned your phone into a payment processor. PYPL operates almost exclusively online. In fact, for years they remained unchallenged until startups like Stripe decided to disrupt their business model.

Where the two differ, comes in where they operate. Square firmly sits in the real world while PayPal lives in the digital. These trends are changing with SQ actively working on establishing their online platform and PYPL’s acquisition of iZettle.

However, you get the sense Square is more interested in becoming the true one-stop-shop for payment processing than PayPal. Both make things easier such as payroll. However, PYPL seems to point to existing ways of using their program (IE mass payments) rather than SQ Payroll which made a specific application for payroll.

Price to Sales Growth Rate Normalization

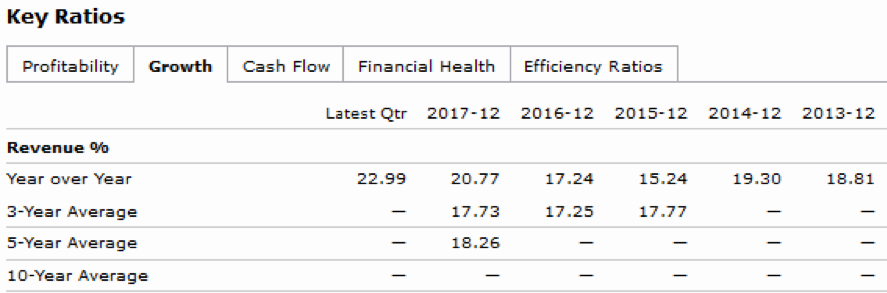

It’s been pointed out Square trades at a much higher P/S multiple than competitors like eBay (EBAY). But, that makes sense considering how much faster SQ continues to grow. PYPL is no slouch. Their 5-year average is 18.26%, and their most recent YOY was 20.77% with the latest quarter at 22.99%.

Source: Morningstar PayPal Analysis

That’s not the same thing as SQ. People pay more for it because the company threw up a 5-year average of 61.20%, and the most recent YOY of 29.59% with the latest quarter at 47.77%.

Leave A Comment