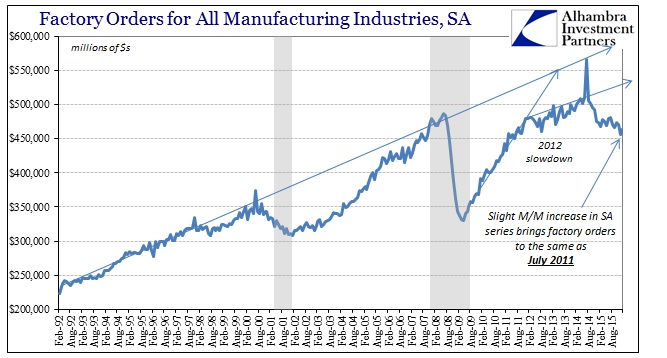

There can be no doubt as to the manufacturing recession in the US, a direct reflection of US consumers. In a fitting confirmation of Chinese manufacturing, US factory orders declined for the 15th consecutive month in January 2016. The year-over-year decline was 3.3%, only slightly better than the revised 4.2% in December, but the length of this continuous decline means that contractions are now stacking. In other words, factory orders in the first month of 2016 might be 3.3% below January 2015, but January 2015 was also 5.3% less than January 2014. The slope might not be impressive, but the steady accumulation of contraction ends up in the same place. Taking longer to get there is actually a far worse indication.

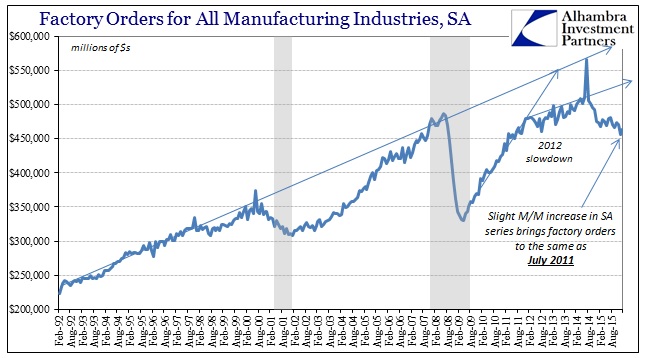

The seasonally-adjusted number in January was higher than February, but as usual the positive variation is barely noticeable in terms of the overall trend. In other words, the lower estimate in December was equivalent to June 2011 while January’s “gain” was basically no different, equivalent to that July.

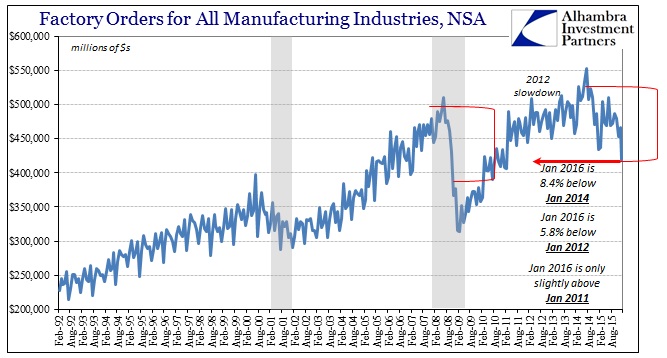

You don’t need the seasonally-adjusted figures to see the recession, however, as it is plainly obvious in the unadjusted set.

At just $419 billion, factory orders in January 2016 were almost 6% less than January 2012 amidst the slowdown that launched QE3 and QE4. As then, there is no way to suggest overheating concurrent to this dislocation across US manufacturing and indeed all US industry. With services clearly slowing too (more on that later), the only difference between 2014-16 and recession is again the slope. It is an obvious and severe slowdown that keeps progressing beyond the typical slowdown – it takes the slope of one but apparently far more than its magnitude in time and ultimate end.

The calendar measurements obscure that point somewhat as again contractions are now stacking. If and when this goes past 24 months later this year, then the slope won’t matter so much as that unending accumulation (such as we see in Brazil).

Leave A Comment