I suspect most of you have never looked up to see a throng of vampire bats overhead. Please imagine if you will, what emotions that sight might evoke. Terror? Awe? Both?

Now substitute bats flying overhead with the image of market charts flying overhead. What do you see? Terror? Awe? Both?

Probably both. Terror in that the indices and Modern Family members are headed every which way creating a sense of chaos and loss of control.

Awe in that this phenomenon is not something we traders see every day. Fascinating really, when you have Regional Banks on new 2016 highs and Retail on 3-month lows.

NASDAQ, depending upon whether it follows Google up or Amazon down sits in a bullish phase although well below key resistance at 119.00. After hours, QQQs took Amazon’s lead south.

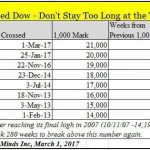

The Dow, not exactly a screamer at least holds considerably above 18,000.

The Russell 2000, not surprisingly, fell further in sympathy with the Retail sector. Trannies are up. Biotechnology put on an oxygen mask to keep it above the key weekly moving average. Semiconductors are gliding, yet not gaining the necessary additional traction it needs to remain at these levels.

Terror and Awe-The market action are like outer space. Are they places of wonder and exploration or places of horror?

Last night we looked at the soft commodities markets shrugging off higher yields and a stronger dollar. Today, Cotton, Corn, Wheat, Soybeans, Coffee, and Livestock closed green.

Gold gained to close basically on the 200 DMA whereas the gold miners closed red and just below the 200 DMA. Oil rose although with an inside trading day (traded within the range of the day before.)

On July 29th, I referenced the idea of stagflation. That’s when the economy is in a recession while experiencing serious inflation.

At that point, the thought came to me as I mused about the Federal Reserve going the way of negative rates. Clearly, the buzz has been about the Fed’s intentions to do the opposite and raise.

Leave A Comment