Stanley Black & Decker (SWK) has put together an amazing track record of dividends over time. The company says it has paid dividends for an almost unbelievable 141 consecutive years and the last 50 of those years have each seen increases in the payout.

Track records like this are almost unheard of and as such, Stanley Black & Decker is truly in a class of its own. It is now part of an ultra-exclusive club of Dividend Kings, a group of just 25 stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash, and this article will discuss Stanley Black & Decker’s qualities that have put it in such exclusive company.

Business Overview

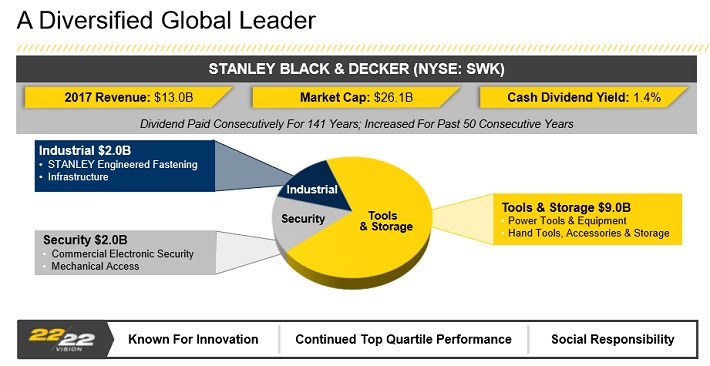

Stanley Black & Decker’s market cap stands right at $24B and the company is expected to do close to $14B of revenue this year. It operates in three separate business lines called Tools & Storage, Industrial, and Security.

Source: paid dividends

The largest segment is the Tools & Storage business while the Industrial and Security businesses make up about 30% of total company sales combined. The company makes all kinds of things that a homeowner, contractor or professional laborer could need to make their lives a little easier, including its famous line of handheld power tools.

In fact, Stanley Black & Decker is #1 in market share in the Tools & Storage business as it dominates that particular niche in the construction, DIY, auto repair and industrial segments with its broad and deep assortment of brands that fit any budget and need. It has formed itself over the past 175 years since its founding in New Britain, CT into a global powerhouse of brands.

That stable of brands grew about a year ago when Stanley Black & Decker added Newell Brands as well as the Craftsman brand for a combined total of just under $3B. Stanley Black & Decker has always been acquisitive, pouncing when the opportunity strikes and growth-by-acquisition is a stated corporate goal.

It takes a measured approach to acquisitions and when great companies come up for sale – like Newell or Craftsman – it will get the deal done. Stanley Black & Decker has used this strategy to spend about $9B on acquisitions since 2002 and the results have been terrific to say the least.

Growth Prospects

That doesn’t mean that Stanley Black & Decker is done growing by any means and in fact, it has a number of strategic initiatives to ensure that it continues to grow in the years to come. Stanley Black & Decker’s acquisition strategy is key and will continue to be a focus for the long term as management has set expectations that roughly 50% of free cash flow is going to be used for acquisitions.

Leave A Comment