Starbucks Corporation (SBUX), together with its subsidiaries, operates as a roaster, marketer, and retailer of specialty coffee worldwide. The company operates in four segments: Americas; China/Asia Pacific; Europe, Middle East, and Africa; and Channel Development.

Starbucks is a dividend challenger, which has increased dividends every single year since it initiated its first dividend in 2010. The last increase occurred in June 2018, when Starbucks hiked its quarterly dividend by 20% to 36 cents/share.

The stock has compounded by 21.90%/year over the past decade. This came off the lows in 2008, when the stock was depressed due to mismanagement and the global financial crisis. Future returns would be much more reasonable in my opinion.

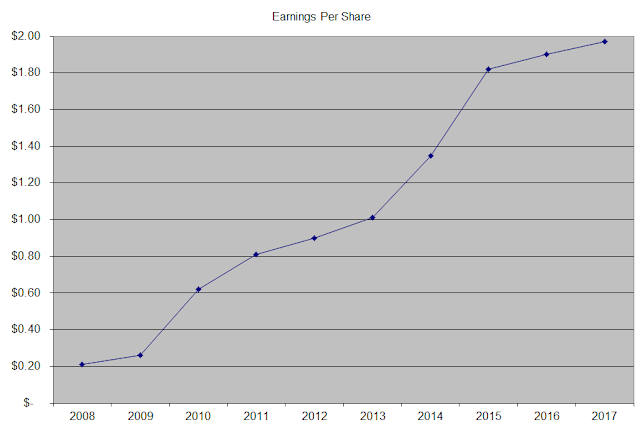

Over the past decade, the company managed to boost earnings from $0.44/share in 2007 to $1.97/share in 2017. Earnings per share growth seems to have slowed down since 2015. That being said, Starbucks is expected to earn $2.41/share in 2018.

Starbucks has a strong brand name, synonymous with quality, customer service and a unique atmosphere at its stores. The company gains from the benefits of scale as it expands its retail store footprint globally. While the US market is close to being saturated in terms of store count, there is plenty of room for growth in countries like China, India, Brazil. The international expansion can be aided by replicating the best practices of stores in the US and then replicating success abroad, one store at a time.

The company can also squeeze in more growth from existing US stores by adding more food items to the menu, while also adding drive-through windows, and extending store hours. Innovation on the digital front, where customers can order on the mobile phones and go, could further boost revenues. In addition, the company has licensed its name to be used for products distributed in grocery stores around the world. This is another revenue stream to capitalize on its strong brand name. Nestle is paying Starbucks Corp $7.15 billion in cash for exclusive rights to sell the U.S. chain’s packaged coffees and teas around the world, tying a premium brand to Nestle’s distribution system. In addition, Starbucks will receive royalties on each products sold. This allows Starbucks to focus on its stores, rather than the consumer packaging segment.

Leave A Comment