I want to say up front that I have no crystal ball for the future. I closely monitor trends but I have found no reliable way to forecast trends. To be a knowledgeable investor you have to monitor both the economy and the stock market. They are two separate but overlapping concepts. It is possible to have an expanding economy and a shrinking stock market and vice versa.

I try to be fully invested when we have both an expanding economy and a rising stock market and on the sidelines when we have a contracting economy and a sinking stock market. I can sleep well either way. I lose sleep and get anxious when the two are going in opposite directions because that is revealing change but what will happen next is the mystery,

At the end of each month I like to gauge what has happened recently to rationally try to figure out what my odds are in making a few bucks in the next month. Here’s how I do that.

For years I have used the research of the Conference Board to evaluate the economy for me. I read their report on Leading Economic Indicators each month. This month the results are:

Jun – 123.5 up

Jul – 123.5 flat

Aug – 123.5 flat

Sep – 123.3 down

The number isn’t important to me but the trend is. In the last three months we were flat to slightly down. That means to me we have either peaked and should be prepared to admit that the expansion in the economy that started around April of 2009 is over or we are just taking a breather from a big expansion or in the end will continue to expand.

For those of you who would like to read more a link: Conference-Board.org

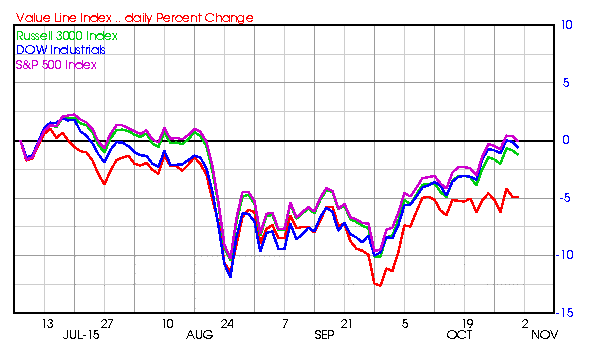

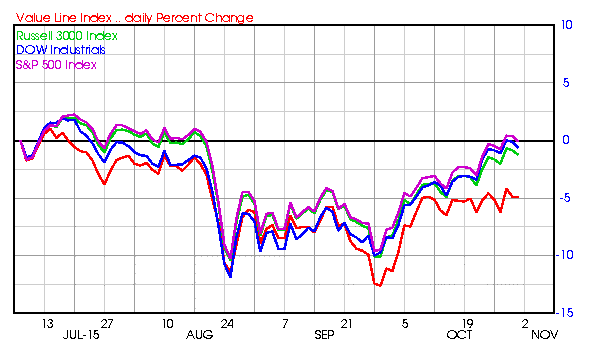

Next I look at the stock market and use four different indices to get a feel of what is happening. I use Barchart to chart the Value Line Arithmetic Index ($VAL), the Dow ($DOW), the S&P 500 ($SPX) and the Russell 3000 ($RUA). The first is not capital weighted, the other three are:

You can see that the weighted indices are back to where they were in July but the non-weighted Value Line is slightly down. That means the larger stocks are driving the market while smaller stocks are down.

Leave A Comment