Holiday trading kicked into gear, although volume for the S&P managed to push into a technical accumulation day. Things are likely to remain quiet through to next week and any sharp moves at this stage have a high risk of failure.

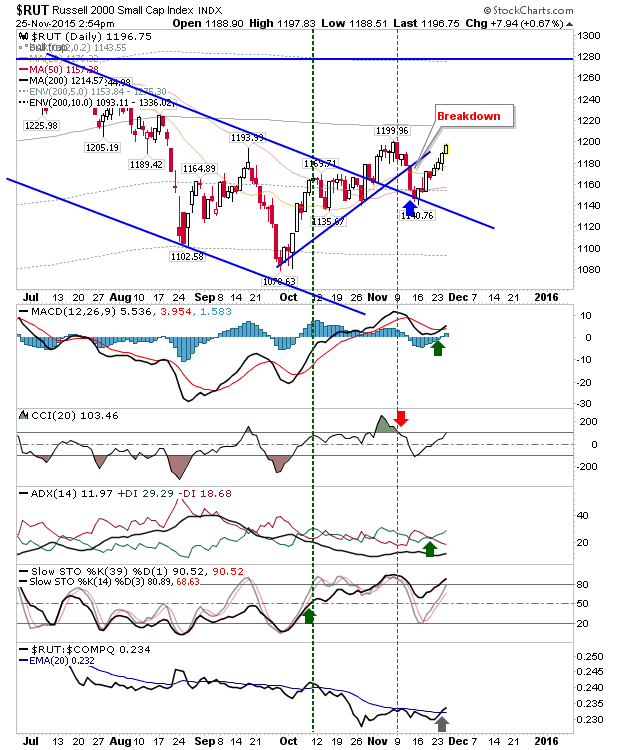

The top performing index on the day was the Russell 2000. It managed to add another decent gain to keep the string of higher closes running. It didn’t quite close above 1,200, but it may do so Friday (with the aforementioned caveat of holiday trading). Overall action in this index has been positive, and relative performance to other indices continues to improve.

The Nasdaq is also ready to break higher. Yesterday’s good response to the negative news headlines has given bulls confidence. There was a ‘buy’ trigger in On-Balance-Volume.

The S&P did enough to register an accumulation day, although it looks like it will finish with neutral doji, which has more in common with churning. Despite the accumulation, the MACD hasn’t moved to a ‘buy’ trigger yet.

If there is an index to lead the breakout it would be the Nasdaq 100. While its proximity to resistance makes the risk:reward more attractive to shorts, bulls can be patient waiting for the move above 4,700.

Tomorrow’s Thanksgiving and Friday’s half-day means we are looking to next week before we can consider a concerted response to recent buying. I’ll be back on Monday. Safe travels for those in transit home for the holiday. Have a great Thanksgiving break.

Leave A Comment