Dollar Is Crashing?

Manufacturing is being helped by the declining dollar. As you can see from the chart below, the dollar has been in a one way path downwards. The DXY hit a 37 month low as it’s down against every major currency in the past year. The daily sentiment index for the dollar is at 14%, meaning investors are extremely pessimistic. This may have been President Trump’s plan ever since he mentioned that the dollar was too high for America to compete on the campaign trail. At Davos, Treasury Secretary Steve Mnuchin’s statement that the dollar weakness isn’t a concern sent the DXY down 0.95% on Wednesday.

The global central banks catching up to the Fed’s hawkishness helps push the dollar down as the ECB is going to end its bond buying by the end of the year and will start raising rates next year. The decline in the dollar has been working in tandem with the increase in oil prices. On Wednesday the price of oil was up 2.33% to $65.96 which is another 3 year high. The rally in stocks, the rally in oil, and the decline in the dollar are 3 of the most overextended price movements.

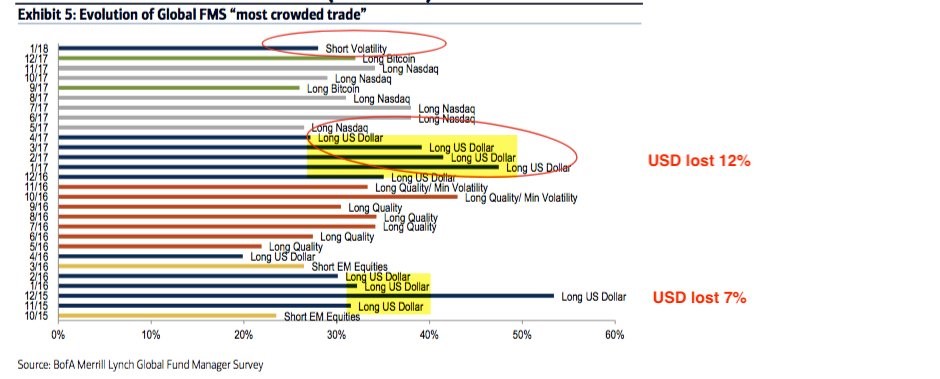

The chart below shows the Merrill Lynch fund managers’ survey which asks managers which is the most overcrowded trade. As you can see, the fund mangers have a great track record with predicting the direction of the dollar. Both times the long dollar trade was said to be overextended, the USD fell. It’s interesting to see how the short dollar trade isn’t considered to be the most crowded trade. The issue might be that so many trades are overextended as many assets have been moving in one direction since the election.

Gold has joined the party which makes sense since the dollar is down and commodities are up. The CRB commodities ETF was up 1.3% on Wednesday and is up 2.58% year to date, signaling inflation will pick up. The breakeven inflation rate is at 2.06%. As you can see from the chart below, the weak dollar policy has helped the interest in gold ETFs reach the highest point in 4 years. Gold was up 1.72% on Wednesday and is up 6.71% in the past 6 months. Gold had a rough Q4 2016 but remains in the uptrend that started in early 2016.

Leave A Comment