“Gentlemen! I too have been a close observer of the doings of the Bank of the United States. I have had men watching you for a long time, and am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country.

When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin!

Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves. I have determined to rout you out, and by the Eternal, (bringing his fist down on the table)I will rout you out.”

Andrew Jackson, in a meeting with the Bankers in Philadelphia, February 1834

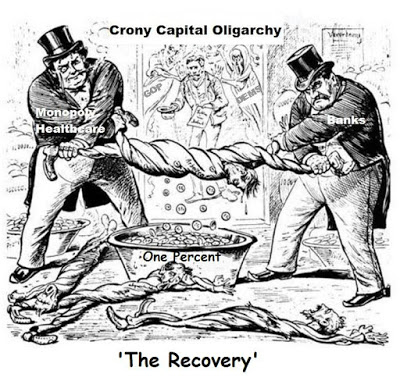

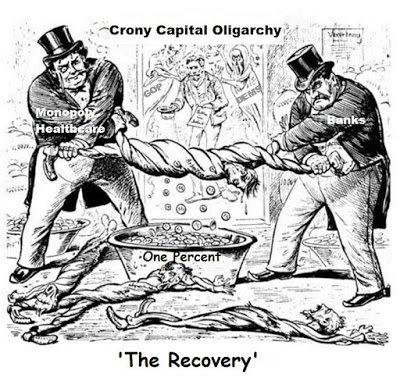

Serious financial reform is almost never discussed in any meaningful way in the political campaign debates, for all the petty sniping and smart remarks that pass for a serious discussion of our policy issues. Life imitates high school.

Goldman Sachs’ Rich Man’s Bank Backstopped by You and Me

By Pam Martens and Russ Martens

October 21, 2015

Just when you thought Wall Street’s heist of the U.S. financial system couldn’t get any crazier, along comes a regulator’s report on FDIC-insured banks exposure to derivatives. According to the Office of the Comptroller of the Currency (OCC), one of the regulators of national banks, as of June 30 of this year, Goldman Sachs Bank USA had $78 billion in deposits, and – wait for it – $45.7 trillion in notional amount of derivatives. (Notional means face amount of derivatives.) According to the OCC report, Goldman Sachs Bank USA’s notional derivatives are an eye-popping 563 percent of its risk-based capital. You and every other little guy in America is backstopping this bank because it’s, amazingly, FDIC insured…

Based on the data, it looks like the average taxpayer is backstopping a ton of risk at this FDIC insured bank and getting very little in return. According to financial data from the FFIEC for the second quarter, the bank had $25.1 billion in trading assets and according to the company’s web site, it’s those high net worth clients of its Private Bank that it’s working with “to manage their cash flow needs, finance private asset purchases, and facilitate strategic investments.”

According to the New York Times, Goldman Sachs private wealth management services require a minimum of $10 million to get in the front door. The same Times article says Goldman was even kicking out its own employees’ accounts if they fell short of $1 million…”

Read the entire article at Wall Street On Parade.

Leave A Comment