U.S. recession risk continues to fade after running moderately higher in recent months. But a variety of business-cycle metrics have only hinted at trouble without crossing the Rubicon. The main concern was linked to higher market volatility. But the economic data merely wobbled without actually falling down. The lesson, once again, is that mastering the art/science of monitoring and evaluating the business cycle requires a methodology that’s based on a spectrum of data that minimizes the potential for confusing market noise with robust macroeconomic signals.

Last week’s news of a strong rebound in US employment in October is among the latest factors that suggest that the imminent threat of a new recession is low. But the notion that a growth bias continues to prevail has been clear all along. A markets-based view of business-cycle risk has popped recently, as I’ve discussed recently. But the increase in Mr. Market’s implied forecast of trouble never reached the tipping point (see here and here, for instance). More importantly, abroad review of economic numbers routinely advised that there was minimal support for the market’s worries.

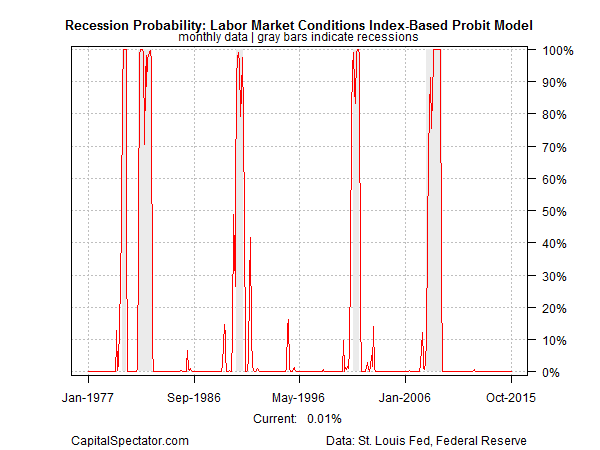

The low-risk outlook for economic risk endures with the current data set. Consider yesterday’s monthly update of the Federal Reserve’s Labor Market Conditions Index, which ticked up to a three-month high in October. Running these numbers through a probit model tells us that the implied risk of a recession for last month was virtually nil.

The econometric case for seeing US macro risk as low extends beyond the employment data. Despite the warnings from the usual suspects in recent weeks that a new recession was assured, my monthly economic profile consistently told us that the recent slowdown in growth was never a clear threat that historically marks the start of downturns (see last month’s abroad review for instance).

Leave A Comment