Our previous Stock Exchange explained some of the important differences between investing and trading. We used Bitcoin as a specific example. If you missed it, a glance at your news feed will show that the key points remain relevant.

This Week: Pullback Fear? Consider Uncorrelated Stocks

Just as a broken clock is right twice a day, pundits warn relentlessly of the next big stock market pullback… until one finally arrives. And considering our almost uninterrupted rally since the depths of the financial crisis more than eight years ago, it’s understandable that some stock market participants are nervous.

Historically, investors have been able to take some risk off the table by investing in bonds. And since the early 1980’s, investors have enjoyed the benefits of sinking interest rates (i.e. when interest rates go down, bond prices go up). But now the tables are turned, interest rates are low and they’re rising—this is a decidedly less attractive situation.

Investment strategies that are less correlated with the overall market (and still offer attractive returns) are compelling because they can significantly reduce risk while simultaneously making money.One of the benefits of our trading strategies is their low correlation with the overall stock market (more on this later).

Something New—More Data

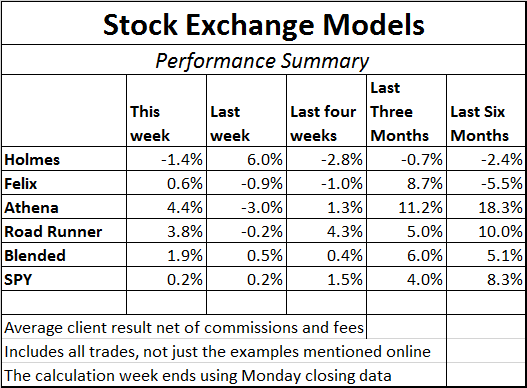

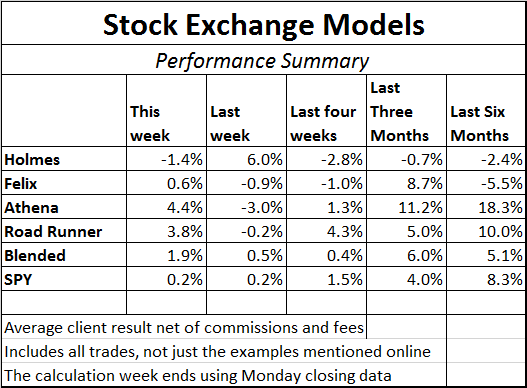

This week we’re implementing something new for our readers. We’re including a table summarizing the results for our models, which work well when combined. The tables show the actual client results after commissions and fees (I watch this every day, and now readers can see it as well). We’ll share additional information, including test data, with those interested in investing. For our weekly updates, we use only real-time results.

The results in the table above include all of the positions (10 for Road Runner and Athena, 16 for Holmes, and 20 for Felix), not just the specific stock examples we discuss in the Stock Exchange every week (and sorry Oscar, you have too many individual stocks and trades to be part of this approach). We’ve included six months of data since that is the shortest real-time record we have. All of the models are expected to perform well over longer time periods. Holmes, for example, has returned over 22% in the last eighteen months.

Leave A Comment