Stock Market Analysis: The world survived the weekend

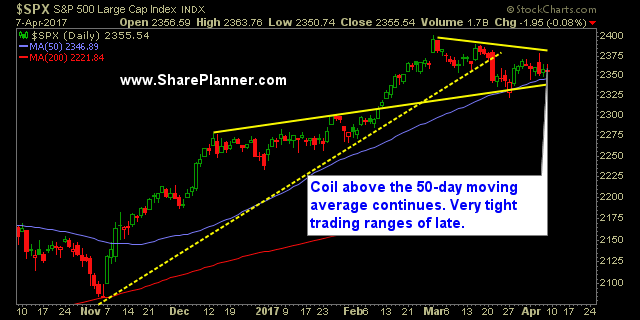

If the world was able to get through the weekend without any major conflicts, or the Fed further weighing in on how overpriced stocks were, the market would probably be in good shape right? Well, so far that seems to be true. Futures are relatively flat, with a slight bullish bend as we near the market open. From a stock market analysis stand point, and more importantly from a technical analysis standpoint, the market hasn’t really moved over the last two trading sessions, but it is holding the 50-day moving average perfectly.

And this has been the key MA for the market. Ever time it has been tested going back to the November election, it has managed to hold. If it breaks, that is going to be bad news for the market.

I’ve stayed away recently from the banks. There just isn’t much predictable movement there, and have instead focused in on Defense, Industrials and Oil. I may look for a little tech exposure too, as that continues to be the strong and most steady sector of the market this year.

On the flip side, small caps continue to under-impress, and I haven’t been overly bullish on that area of the market.

It is a new day, and new week. Let’s see what this market has to offer!

S&P 500 Chart

?

?

Current Stock Trading Portfolio Balance:

4 Long positions

Recent Stock Trade Notables:

Las Vegas Sands (LVS): Long at 57.24, closed at 56.53 for a 1.2% loss.

UPRO: Long at 91.94, closed at 96.54 for a 5.0% profit.

Alibaba Group (BABA): Long at 105.736, closed at 108.22 for a 2.4% profit.

Facebook (FB): Long at 134.27, Closed at 139.23 for a 3.7% profit.

CDW Corp (CDW): Long at 58.65, closed at 58.91 for a 2.7% loss.

Redhat (RHT): Long at 82.41, Closed at 83.53 for a 1.4% profit.

Ambarella (AMBA): Long at 57.15, Closed at 55.52 for a 2.8% loss.

Alibaba Group (BABA): Long at 104.73, closed at 106.05 for a 1.3% profit.

Broadcom (AVGO): Long at 218.63, Closed at 222.71 for a 1.9% profit.

American Airlines (AAL): Short at 44.76, Closed at 44.03 for a 1.6% profit.

UPRO (Day-Tade): Long at 95.35, closed at 96.50 for a 1.2% profit.

OZRK: Long at $56.12, closed at $54.69 for a 2.5% loss.

FNSR: Long at $34.25, closed at 34.70 for a 1.3% profit.

UPRO (Day-Tade): Long at 96.92, closed at 98.03 for a 1.2% profit.

JP Morgan Chase (JPM): Long at 87.21, closed at 89.67 for a 2.8% profit.

Chevron (CVX): Short at 110.03, covered at 111.85 for a 1.6% loss.

Flex Technologies (FLEX): Long at $15.62, closed at $16.57 for a 6.1% profit.

Baidu (BIDU): Long at $174.70, closed at $187.00 for a 7.0% profit.

Ollie’s Bargain Outlet: Long at 33.20, closed at $32.50 for a 2.1% loss.

Corning (GLW): Long at $26.98, closed at $27.45 for a 1.7% profit.

Illinois Tool Works (ITW): Long at $127.74, closed at $129.86 for a 1.7% profit.

Marriott Int’l (MAR): Long at $86.16, closed at $87.51 for a 1.6% profit.

?

Leave A Comment