The Dow Jones Industrial Average peaked at 26,616 on January 26th. Those highs set the stage for the stock market correction that investors are facing right now.

How and Why?

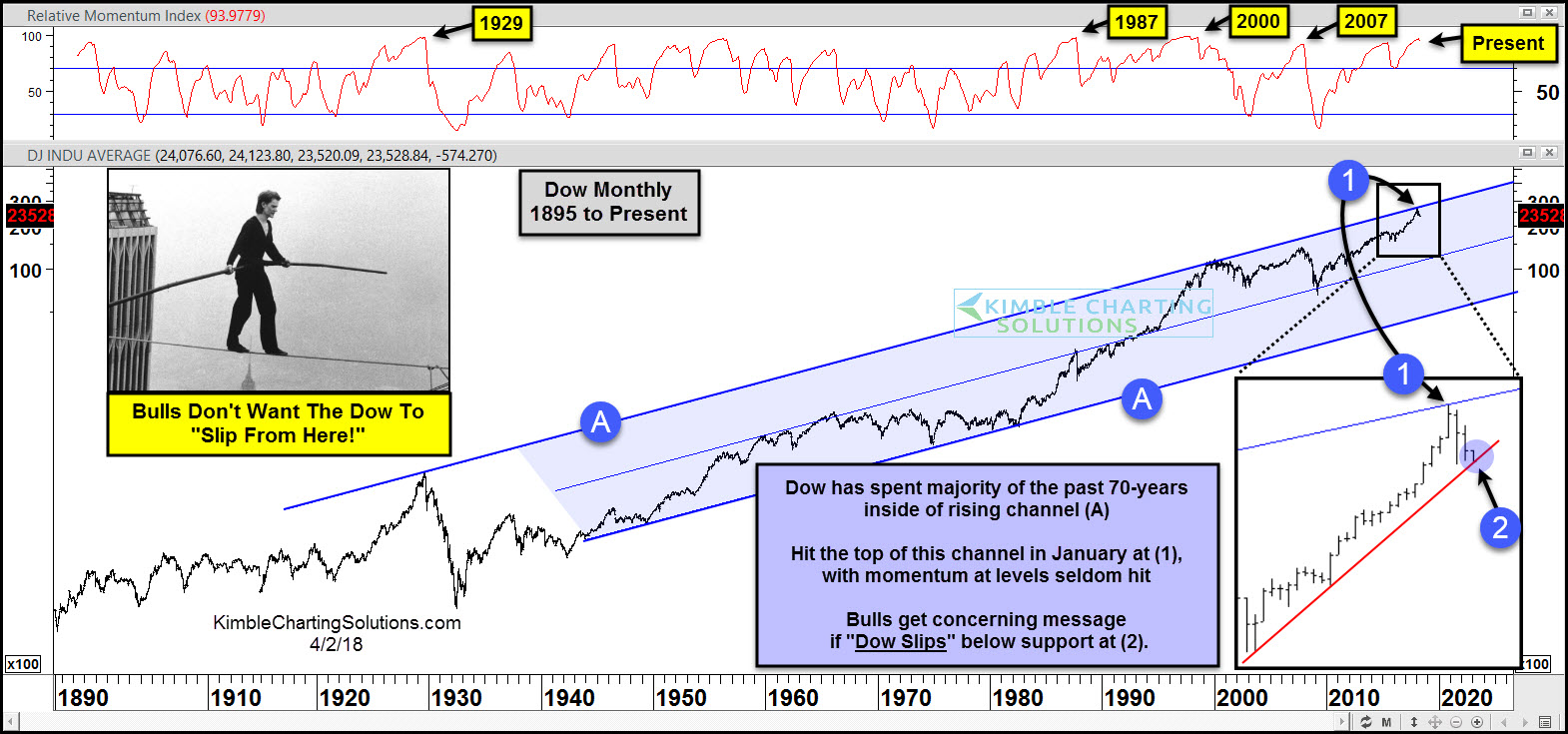

We’ve been warning since early this year that stocks were getting ahead of themselves. The chart below illustrates just how far ahead they got… the Dow’s momentum reading this year reached levels not seen since 1929, 1987, 2000, and 2007. At the same time, the Dow’s price reached the top side (point 1) of a 70-year rising channel (point A).

Decision Point

The stock market correction has taken the Dow Jones down to an important intermediate-term support point – its rising “monthly” trend line off the 2016 lows (point 2). What happens here could determine whether this is a “run of the mill” correction or something more ominous.

Any puncture of support would need to be short-lived for the intermediate uptrend to remain intact. However, if bulls fail to adequately defend this trend line, then the market decline could get ugly. Stay tuned!

Dow Jones Industrial Average Long-Term Chart

While many have been focused on the 200-day moving average test for the S&P 500, the Power of the Pattern is of the opinion this is one very Important “Support Test” in play for the Dow. Support is support friends until broken.

Leave A Comment