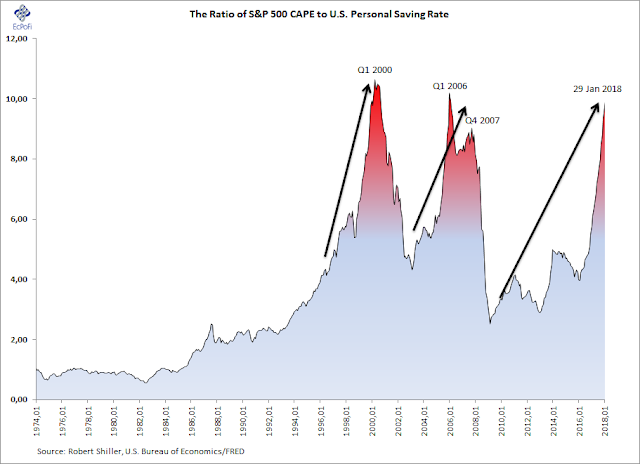

One month ago today I pointed out the growing gap between the S&P 500 CAPE and the personal saving rate in the U.S. (see The ‘CAPE To Saving Rate’ Ratio Signals A Terrible 2018 For U.S. Stocks), a ratio which helped identify the two previous stock market bubbles. At the time the ratio clocked in at 9.33. Today it comes in at 9.91, a 6.2% increase in just one month, and quickly closing in on the record set during the highs of the dot-com bubble.

Since Trump got elected, the ratio has nearly doubled thanks to a highly toxic combination of a slowing rate of saving (down 35.1%) and a spiking P/E multiple (up 20.6%).

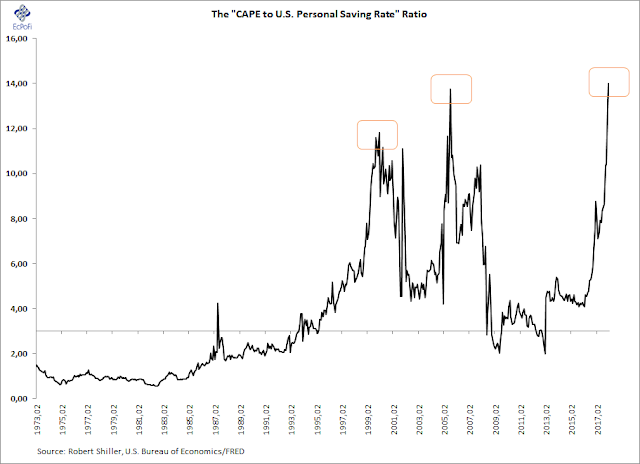

The above ratio is based on the 12-months average saving rate. If we compare the CAPE with the monthly saving rate, however, the ratio now even surpasses the dotcom highs, with quite a margin.

As I explained in the article linked above, the euphoric heights of this ratio indicate troubles ahead for both the U.S. stock market and the economy in 2018, troubles which will spill over to other economies around the globe as well. And do keep in mind that debt levels are substantially higher this time around, especially federal debt. Something simply has to give at this stage, sooner or later.

Leave A Comment