Stock market indexes gain around 1 percent today. Small cap index Russell 2000 is about close around 1382 points, a gain of 1.15 percent, the best performing U.S. stock market index of the day.

How meaningful was today’s strong day in the stock market mean in the bigger picture?

In order to answer that question, investors should turn to leading stock market indicators. In this article, two leading indicators are revised: the transportation index and biotechnology.

Based on the current set up of these two indicators, InvestingHaven‘s research team believes there is a fair chance that stocks particularly in the U.S. are “going nowhere”.

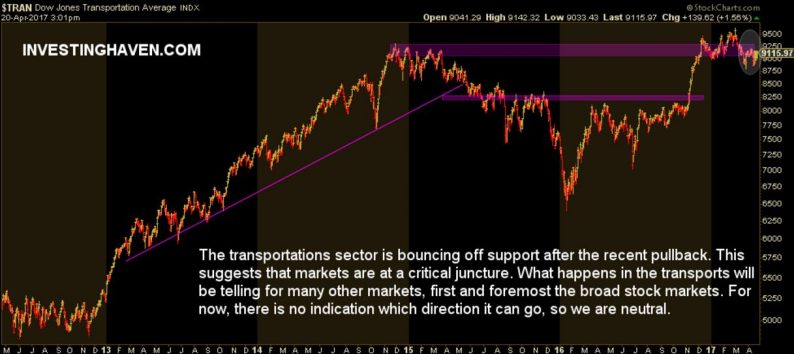

First, the transportation index is simply bouncing back from a retracement which brought the index down from 9550 to 8800 points. Transportations are now slightly recovering, but in the bigger picture of things they are still trading near major support, see the circle on the first chart.

As long as there is no clear direction here, the odds favor a trendless market. Investors watch for a potential divergence between transportations and the Dow Jones index which would be bearish according to the Dow Theory.

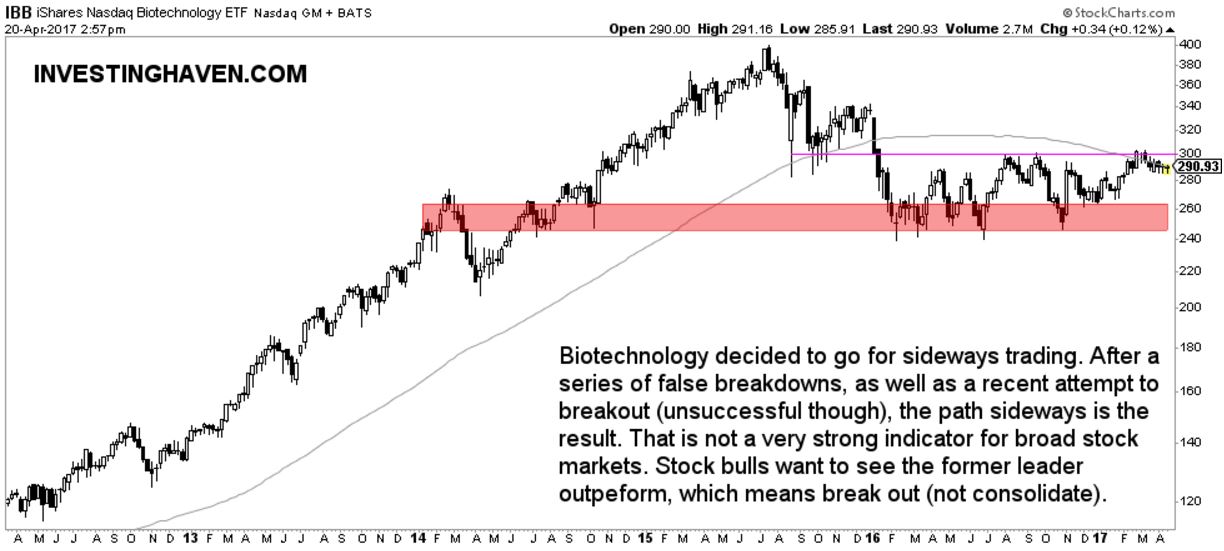

Furthermore, although not a leading indicator, the biotechnology sector is certainly a health indicator. Right now, biotech is simply moving sideways. We have noticed several times that biotech was about to break down or, recently, break out. But the sector did refuse to go either direction, it is basically going sideways.

Because of the setup in those two stock market indicators, InvestingHaven believes that the stock market could follow their trendless state, and basically “go nowhere” in the coming months. The question is: will bulls or bears first give up during this nerve wracking situation?

Leave A Comment