To say that I have enjoyed this week of trading so far, or even this month for that matter would be an overstatement of the grossest of proportions (somewhere an English major is probably having fits with that sentence). The market has hardly moved, and when it has, it has quickly been faded each time, regardless of then current direction, the opposite way to simply close the market flat.

Now today we have another weak open, and while we may sell off further once the market opens, nonetheless, the bulls at some point will likely try to drive the market back up to break even.

And if we were to of opened up higher this morning, the exact opposite would have been true. Rally a little higher after the open and then kill the market in the afternoon.

The CBOE Market Volatility Index (VIX) continues to be quite an interesting watch. Yesterday marked the highest close for it since the election of Donald Trump. If you ask me, I’d say that thing is ready to crash and burn again. It has been the norm for the past four months in particular, and I expect it to be the norm still.

On the other hand, you have the T2108 (% of stocks trading above their moving average) hitting almost 55% and sporting a rather nice inverse head and shoulders pattern on the daily chart. That is the most bullish that I have seen it, in months.

So there are definitely some divergences out there, and then you have the lingering threats of N. Korea and Syria and all the saber rattling that goes along with it. And on Friday for Good Friday, so that adds an extra day for the market to be closed.

But lets stay focused, keep working this market and get through the challenges the market sends our way.

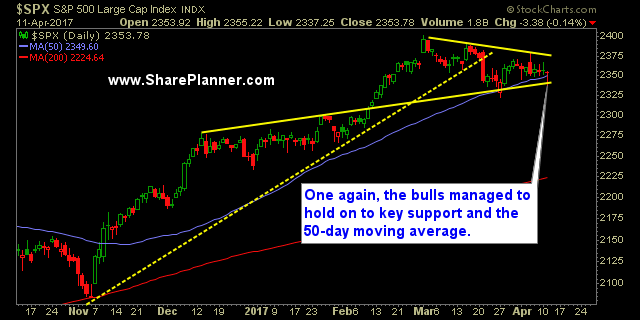

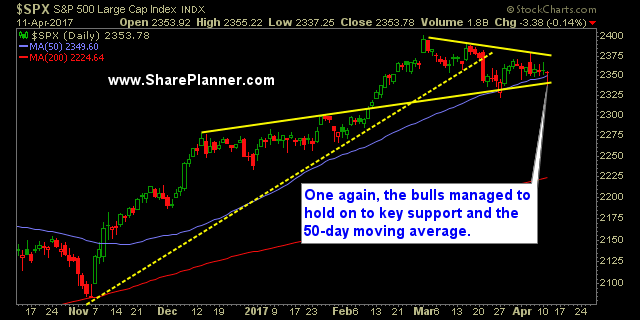

S&P 500 Chart

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables:

Leave A Comment