Last weekend, we noted that the cyclical top in the stock market had entered an important phase of its development. The massive distribution pattern that has been forming since 2014 indicates that the cyclical bull market from 2009 likely terminated in July of last year.

The potential cyclical downtrend from July is testing critical support in the 1,880 area on the S&P 500 index. A subsequent weekly close well below that level would signal an acceleration of the decline into a true market crash and predict substantial additional losses.

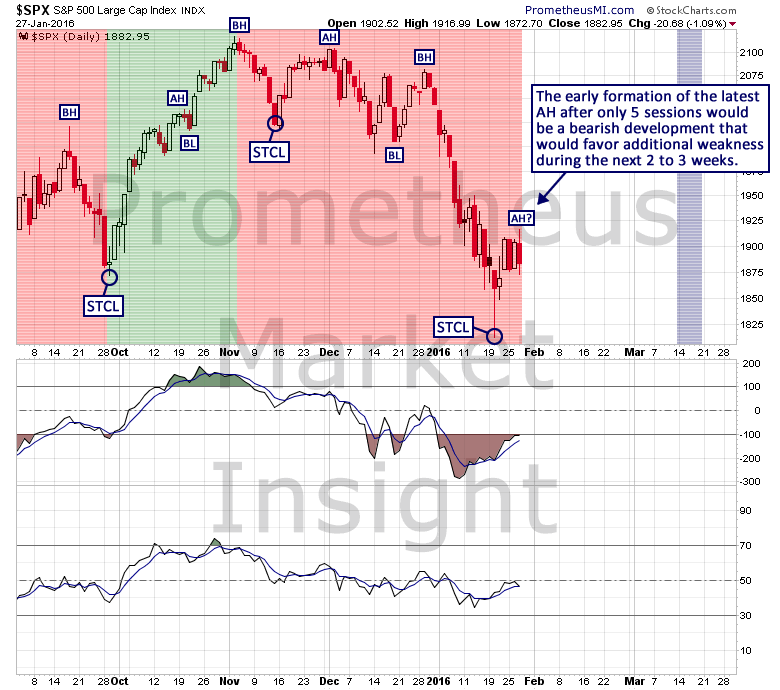

From a short-term perspective, we have been monitoring closely the character of the latest cycle that began last week. We are 5 sessions into the alpha phase rally of the current cycle and the rebound has struggled to advance during the last 3 sessions, suggesting that the alpha high (AH) may have formed today.

The confirmed formation of the latest AH after only 5 sessions would be an extremely bearish short-term development that would predict a quick move below the critical long-term support at the 1,880 level on the weekly chart. Therefore, it will be important to monitor stock market behavior closely during the next several sessions.

Leave A Comment